US Tech analysis: the index is poised for a correction

The US Tech stock index has failed to reach another all-time high and is now poised for a correction. Find out more in our US Tech price forecast and analysis for next week, 16-20 December 2024.

US Tech forecast: key trading points

- Recent data: US nonfarm payrolls stood at 227 thousand in November

- Economic indicators: labour market indicators reflect the state of the economy and may influence decisions by the US Federal Reserve

- Market impact: robust data may support stock growth, especially in sectors sensitive to consumer demand

- Resistance: 21,640.0, Support: 21,400.0

- US Tech price forecast: 20,975.0

Fundamental analysis

The actual result on US nonfarm payrolls in November was 227 thousand, exceeding analysts’ expectations of 202 thousand and the previous reading of 36 thousand.

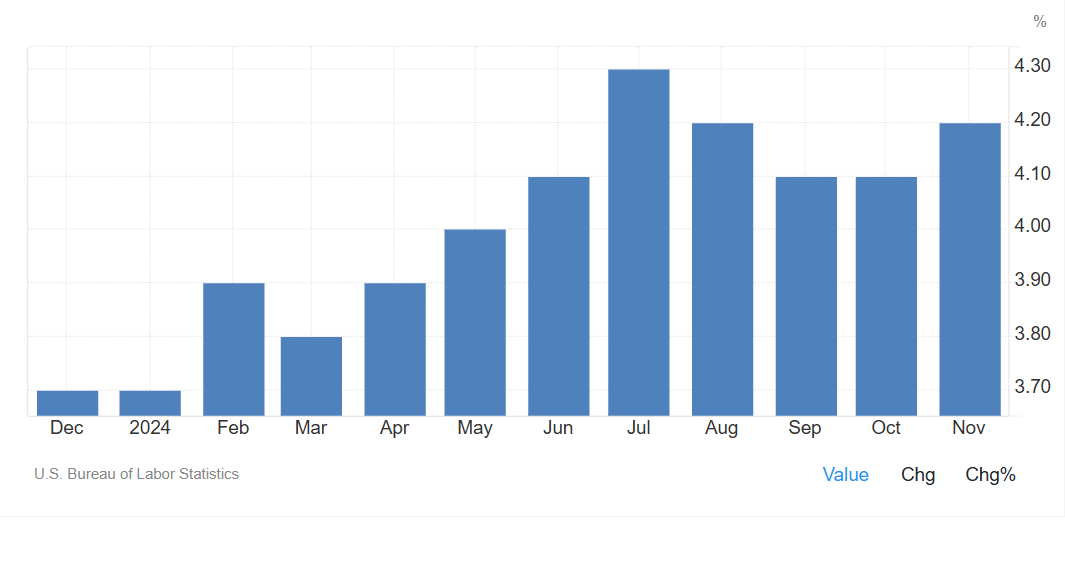

Source: https://tradingeconomics.com/united-states/unemployment-rate

The US unemployment rate stood at 4.2% in November, aligning with analysts’ expectations. A 0.1% increase can be considered insignificant and attributed to a rise in the number of people actively seeking employment again. This does not suggest a sharp weakening of the economy.

The strong NFP reading highlights a stable labour market, which is positive for equities but may reduce the likelihood of further monetary policy easing by the Federal Reserve. This could negatively affect stocks that benefit from cheap capital (for example, the technology sector). Although the uptick in unemployment is minimal, it may still fuel concerns about the end of the economic growth momentum. The US Tech index forecast is moderately pessimistic.

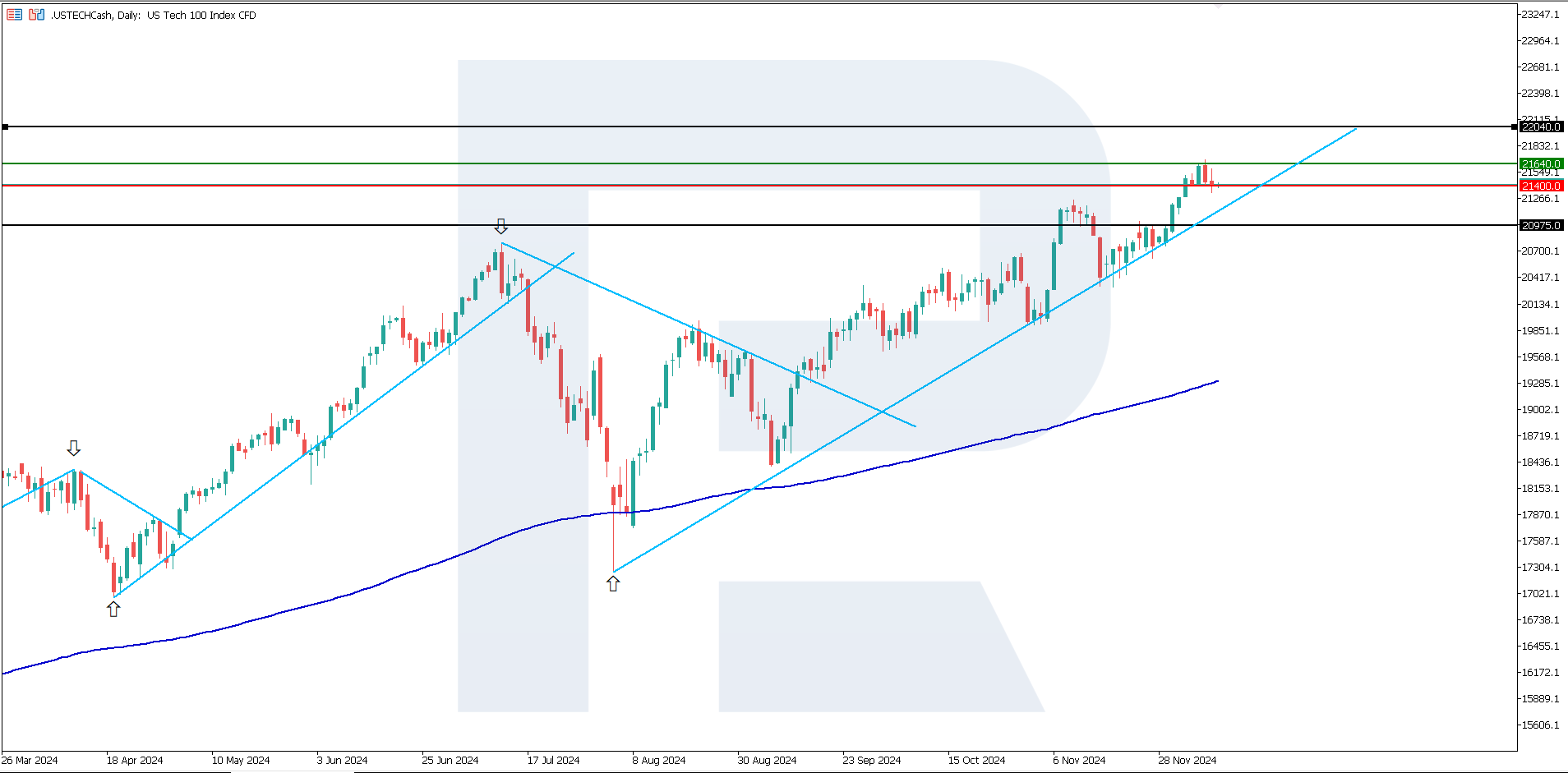

US Tech technical analysis

The US tech stock index halted its rise, with a pause in the uptrend now emerging, potentially leading to a correction. According to US Tech technical analysis, the decline will likely be short-lived as there are no indications of a prolonged downtrend. A sideways channel could form before the price resumes upward following the correction. Nevertheless, the global trend for the index remains upward.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 21,400.0 support level could drive the index down to 20,975.0

- Optimistic US Tech forecast: a breakout above the 21,640.0 resistance level could push the index to 22,040.0

Summary

The US unemployment rate stood at 4.2% in November, which aligns with analysts’ forecasts, and the actual US nonfarm payrolls totalled 227 thousand. These strong labour market indicators could weigh on the technology segment. For this reason, the US Tech index is expected to undergo a short-term correction.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้