US 500 analysis: growth rate slows but a new all-time high is still likely

The US 500 stock index will likely attempt to reach a new all-time high before a correction. Find out more in our US 500 price forecast and analysis for next week, 16-20 December 2024.

US 500 forecast: key trading points

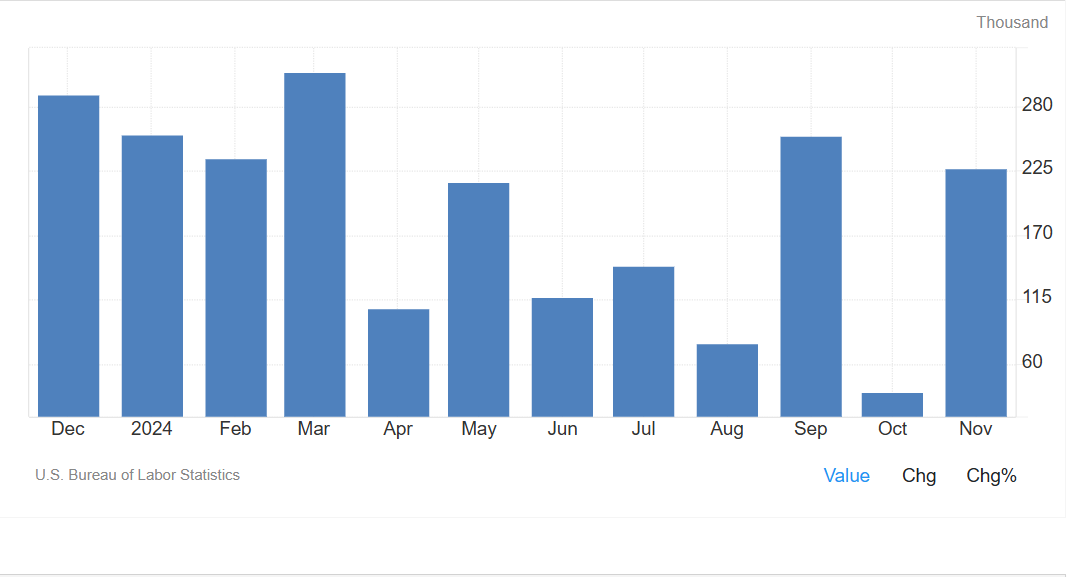

- Recent data: US nonfarm payrolls (NFP) reached 227 thousand in November

- Economic indicators: the NFP data significantly impacts the stock market as it shows the state of the economy and may affect the Federal Reserve's decisions

- Market impact: an interest rate cut favourably impacts the stock market when the labour market is weak

- Resistance: 6,095.0, Support: 5,985.0

- US 500 price forecast: 6,125.0

Fundamental analysis

The actual NFP came in at 227 thousand, above the expected 202 thousand and the previous 36 thousand. The stronger-than-forecast reading indicates that the US economy is creating jobs faster than expected. Job growth typically has a positive impact on consumption and economic growth, supporting the stock market.

Source: https://tradingeconomics.com/united-states/non-farm-payrolls

The unemployment rate came in at 4.2%, aligning with expectations and above the previous reading of 4.1%. Unemployment growth of 0.1% can be considered insignificant and attributed to an increase in the number of people looking for jobs again. It does not signal a sharp weakening of the economy. A strong labour market may reduce the likelihood of the third Federal Reserve rate cut in 2024, adversely impacting stocks that benefit from cheap money (for example, the technology sector).

Oppenheimer Asset Management expects the S&P 500 index to continue its record rally and hit the 7,100 level by the end of next year on the back of a strong economy. These expectations are currently the most positive among similar companies. The US 500 index forecast is cautiously optimistic.

US 500 technical analysis

The US 500 stock index is aiming for a new all-time before a correction. According to the US 500 technical analysis, the decline will be short-lived, and the uptrend will resume. A global trend reversal is not expected in the medium term. A sideways channel could form at the beginning of next year, with the next growth target at 6,125.0.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,985.0 support level could push the index down to 5,885.0

- Optimistic US 500 forecast: a breakout above the 6,095.0 resistance level could propel the index to 6,125.0

Summary

The US unemployment rate came in at 4.2% in November, aligning with expectations and above the previous reading of 4.1%. Unemployment growth of 0.1% can be considered insignificant and attributed to an increase in the number of people looking for jobs. The US Federal Reserve will not consider it as a sign of a weakening economy and will likely pause the key rate-cutting cycle. In this case, the US 500 index may see a sideways range forming.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้