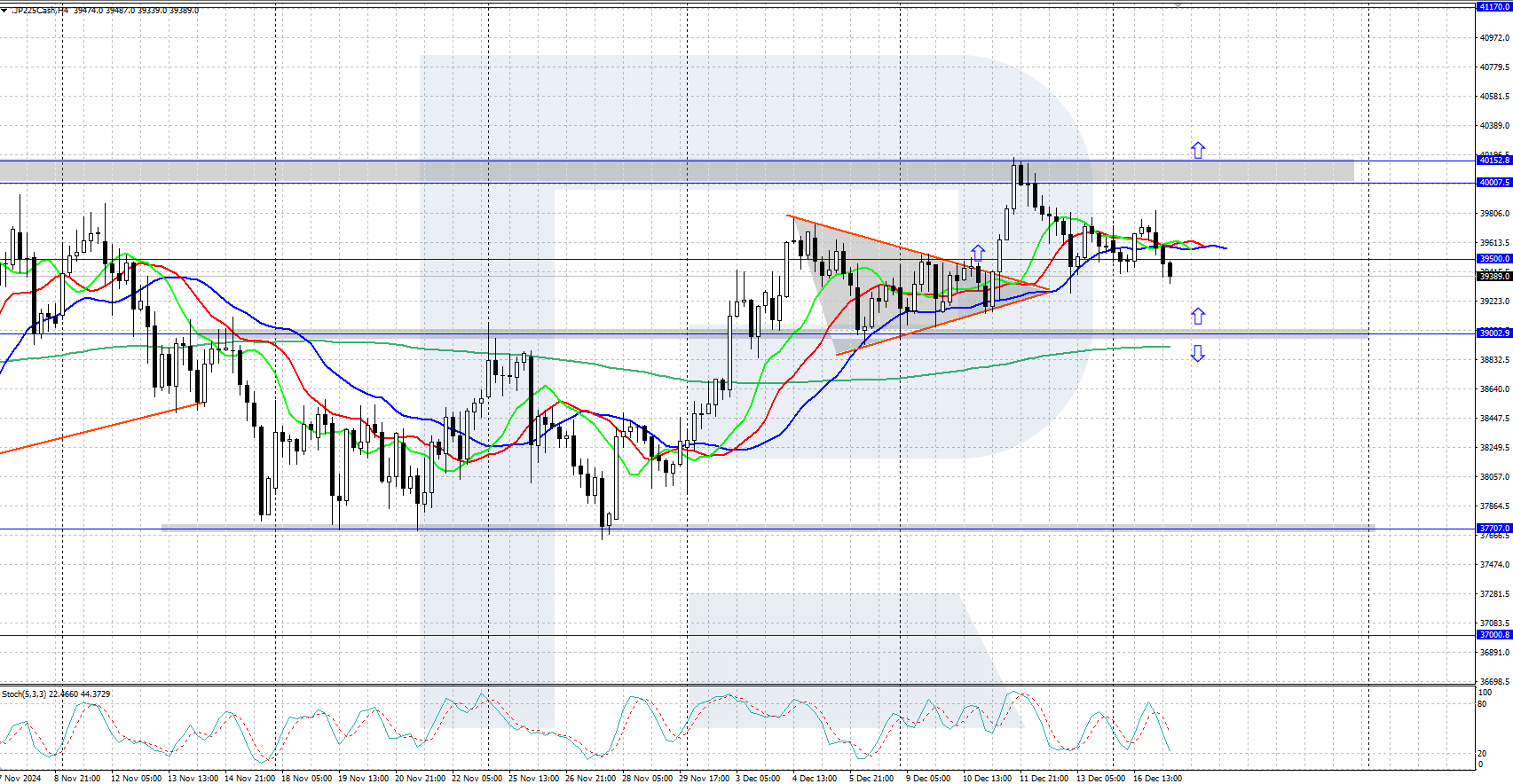

JP 225 analysis: the index failed to hold above the 40,000.0 level

The JP 225 stock index is experiencing upward momentum on the chart. Last week, the quotes rose above the 40,000.0 level but failed to consolidate there, subsequently entering a correction. The JP 225 forecast for next week is moderately negative.

JP 225 forecast: key trading points

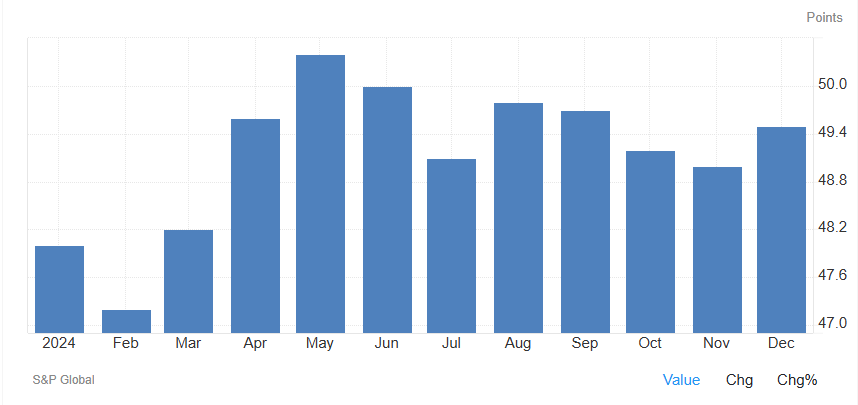

- Recent data: the Jibun Bank Japan manufacturing PMI rose to 49.5 points in December

- Economic indicators: this leading indicator reflects business activity in Japan’s manufacturing sector

- Market impact: an increase in the index indicates a positive trend in Japan’s industrial production, while a decline signals a negative trend

- Resistance: 40,000.0, Support: 39,000.0

- JP 225 price forecast: 39,000

Fundamental analysis

The Jibun Bank Japan manufacturing PMI rose to 49.5 points in December 2024, up from 49.0 in November. This growth exceeded market expectations of 49.2 points, marking the highest reading since September 2024.

Source: https://tradingeconomics.com/japan/manufacturing-pmi

The main events influencing the JP 225 index movements this week are the US Federal Reserve’s interest rate decision on Wednesday and the Bank of Japan’s decision on Thursday. Market participants widely expect the Federal Reserve’s decision to raise the rate by 25 basis points.

However, the outcome of the Bank of Japan’s decision is less certain. Most experts are inclined to believe that the interest rate will remain unchanged at this meeting as Bank of Japan officials may require additional time to assess recent economic data. A rate hike is more likely to occur at the next meeting in early 2025.

JP 225 technical analysis

The JP 225 index is undergoing a downward correction after reaching the psychologically important level of 40,000.0 last week. The nearest support level is at 39,000.0, and the index could resume its upward trajectory once the correction concludes.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: if the price falls below the 39,000.0 support level, the index could decline to 37,700.0

- Optimistic JP 225 forecast: if the price consolidates above 40,000.0, the index could rise to 41,170.0

Summary

The JP 225 stock index is in a downward correction after failing to consolidate above the psychologically significant level of 40,000.0. Market participants are awaiting the Bank of Japan interest rate decision on Thursday.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้