DE 40 analysis: the index gradually declines, retracing to 19,000.0

The DE 40 stock index has fallen slightly this week, approaching the 19,000.0 mark. The DE 40 forecast for next week remains negative.

DE 40 forecast: key trading points

Fundamental analysis

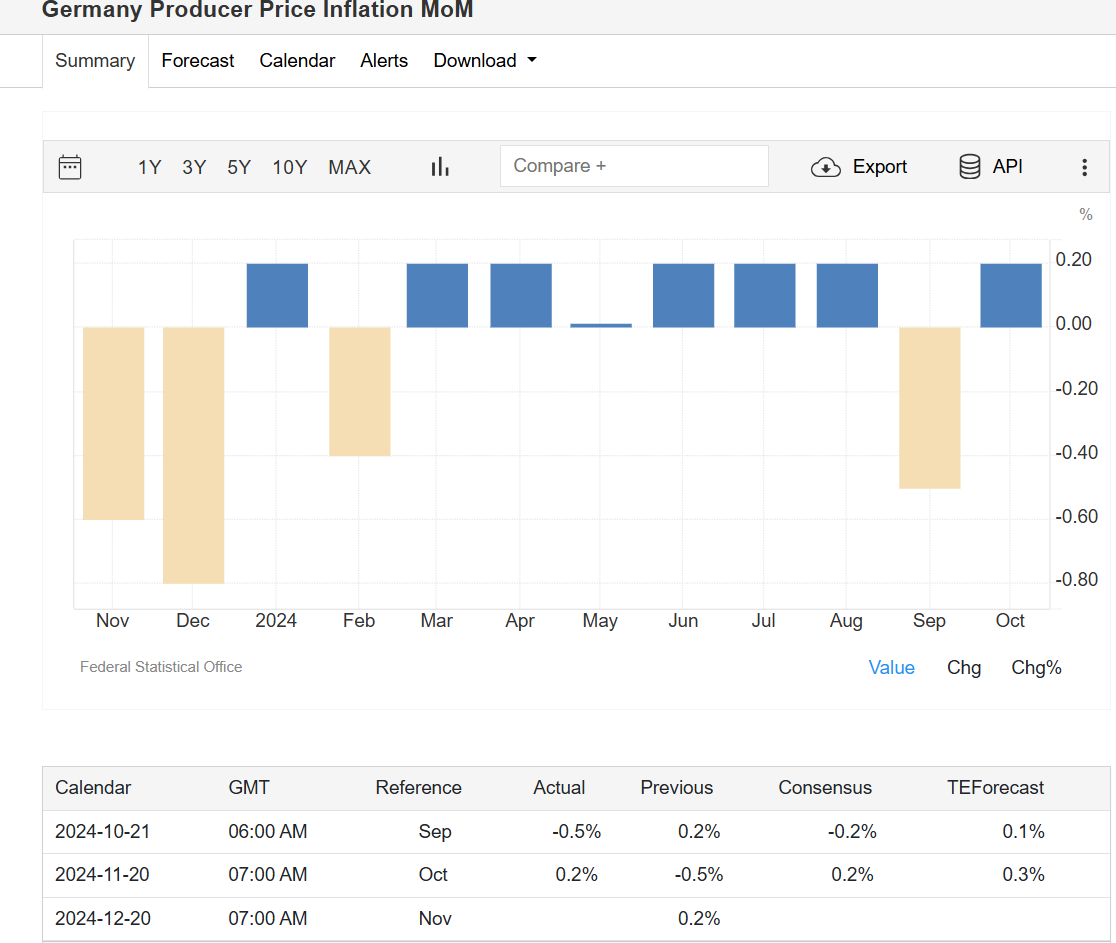

According to this week’s data, Germany’s PPI increased by 0.2% from the previous month, in line with analysts’ expectations. In September, the index had decreased by 0.5%.

Source: https://tradingeconomics.com/germany/producer-price-inflation-mom

European stock markets have shown a gradual decline on Wednesday and Thursday amid a further escalation of the Russia-Ukraine conflict. Investors are selling off risky assets due to concerns about the current conflict’s potential expansion, with the possible involvement of NATO countries.

Germany’s automotive industry recorded the most considerable losses on Wednesday, with Mercedes-Benz, Volkswagen, and Porsche stocks falling by 1.40-3.00%. The healthcare sector also faced pressure, with Bayer and Fresenius declining by 2.00%. Germany’s 10-year bond yield rose above 2.35% on Wednesday.

DE 40 technical analysis

The DE 40 index is edging down this week, retracing to the 19,000.0 level. There is no clear trend now, with the index trading within a broad price range from 18,837.0 to 19,570.0. The price’s direction outside the range will determine the index’s prospects.

The following scenarios are considered for the DE 40 price forecast:

Summary

The DE 40 stock index is declining this week, retracing to the 19,000.0 level. Investors are concerned that the current conflict between Russia and Ukraine may escalate, potentially involving NATO countries.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้