DE 40 analysis: the index maintains its upward trajectory, rising above 20,300.0

This week, the DE 40 stock index continues to rise, remaining firmly above the psychologically important 20,000.0 level. The DE 40 forecast for next week is positive.

DE 40 forecast: key trading points

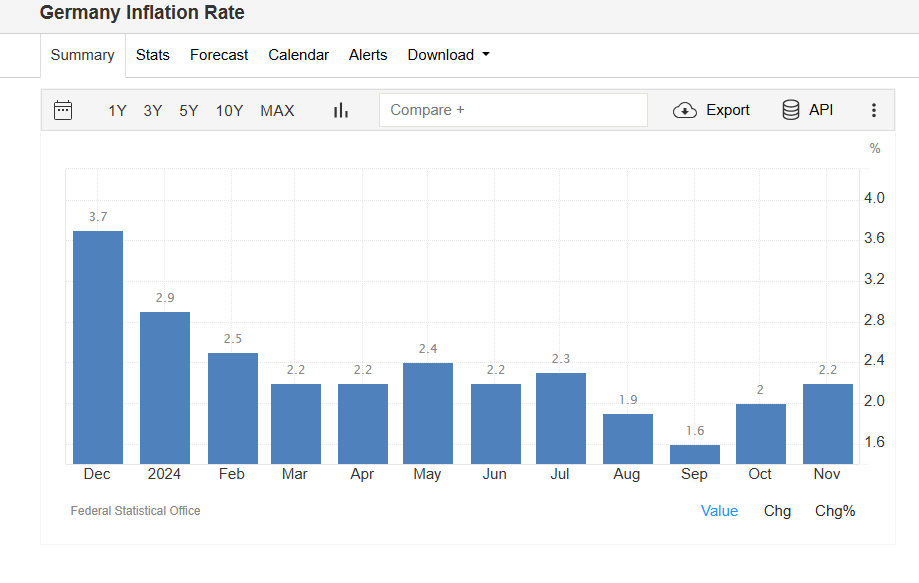

- Recent data: Germany’s annual inflation rate increased to 2.2% in November

- Economic indicators: the Consumer Price Index (CPI) measures the rate of inflation in the country

- Market impact: moderate inflation growth supports the stock market, while strong growth has a negative effect

- Resistance: 20,500.0, Support: 20,300.0

- DE 40 price forecast: 20,500.0

Fundamental analysis

According to the released CPI data, Germany’s annual consumer inflation rose to 2.2% in November from 2.0% in October, marking the highest level in the past four months. The indicator fell by 0.2% month-on-month.

Source: https://tradingeconomics.com/germany/inflation-cpi

Yesterday’s US consumer inflation data matched forecasts: market participants expect the Federal Reserve to cut the interest rate by 25 basis points again next week. Today, the market will focus on the ECB’s monetary policy decision, with expectations for another rate cut and comments on next year’s outlook for interest rates.

The DE 40 index is following the upward movement of US stock indices this week, breaking above the 20,300.0 level. The biggest gainer is Siemens stock, which set a new all-time high of 96.70 EUR per share. The shares have gained about 10% over the past four weeks, with annual gains totalling about 20%.

DE 40 technical analysis

The DE 40 index continues to strengthen this week, reaching a new all-time high of 20,500.0 points. A strong uptrend persists, with prices remaining firmly above the psychologically important 20,000.0 level. Growth is expected to continue as long as the index stays above this threshold.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: if the price drops below the 20,000.0 level, the index could correct towards 19,000.0

- Optimistic DE 40 forecast: if the price breaks above the 20,500.0 resistance level, it could continue its upward movement to 21,000.0

Summary

The DE 40 stock index maintains its upward momentum, reaching a new all-time high of 20,500.0 points this week. The trend is upward, so the index could continue to rise.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้