EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD technical analysis and forecast for 25-29 November 2024

Here is a detailed weekly technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD for 25-29 November 2024.

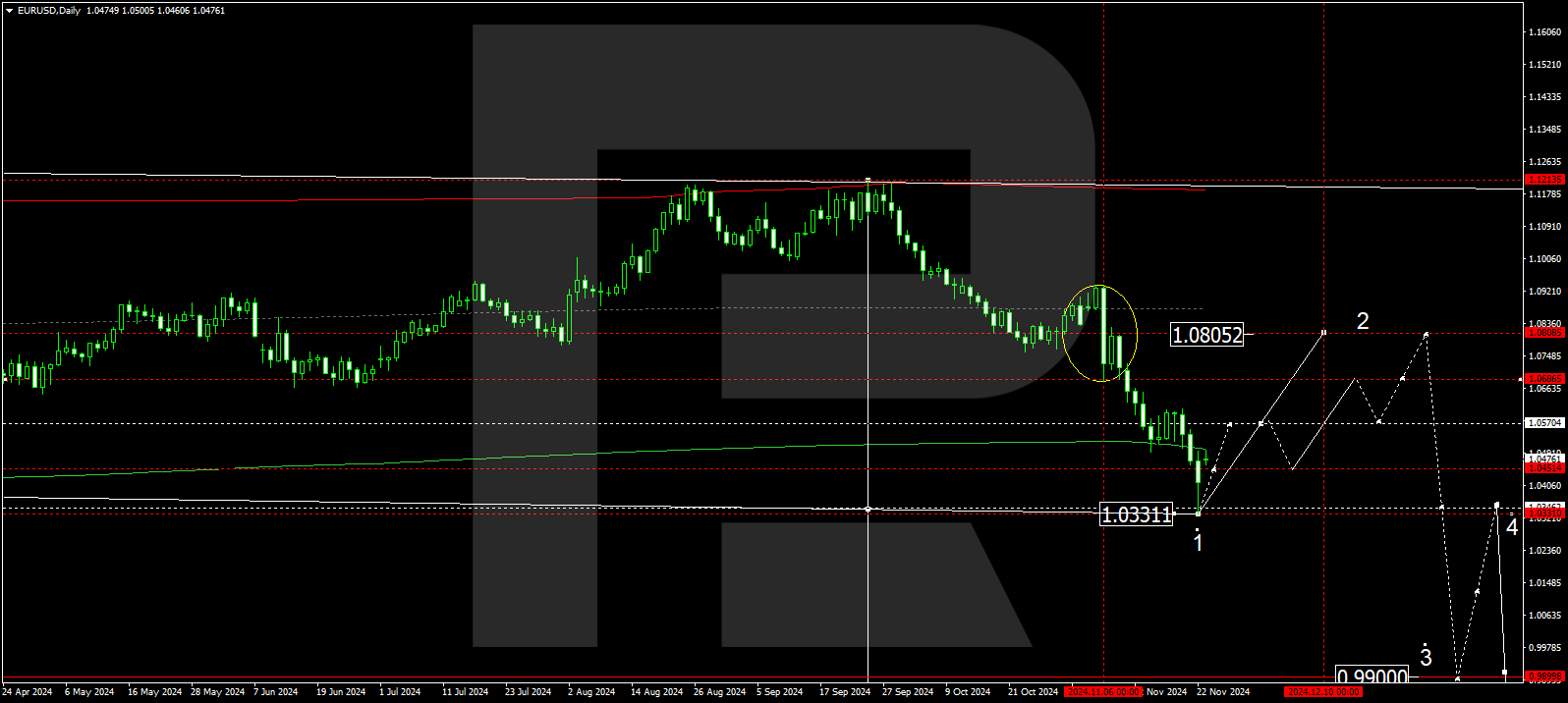

EURUSD forecast

The EURUSD pair has reached the first target of the downward wave, 1.0331. The market rose to 1.0414 and formed a consolidation range around this level. With an upward breakout above the range today, the price reached the first wave’s target of 1.0500. A decline towards 1.0414 is expected, followed by a potential growth wave towards 1.0570 and potentially extending further to 1.0650. A more substantial corrective wave could develop in the EURUSD pair, aiming for 1.0800, the estimated target.

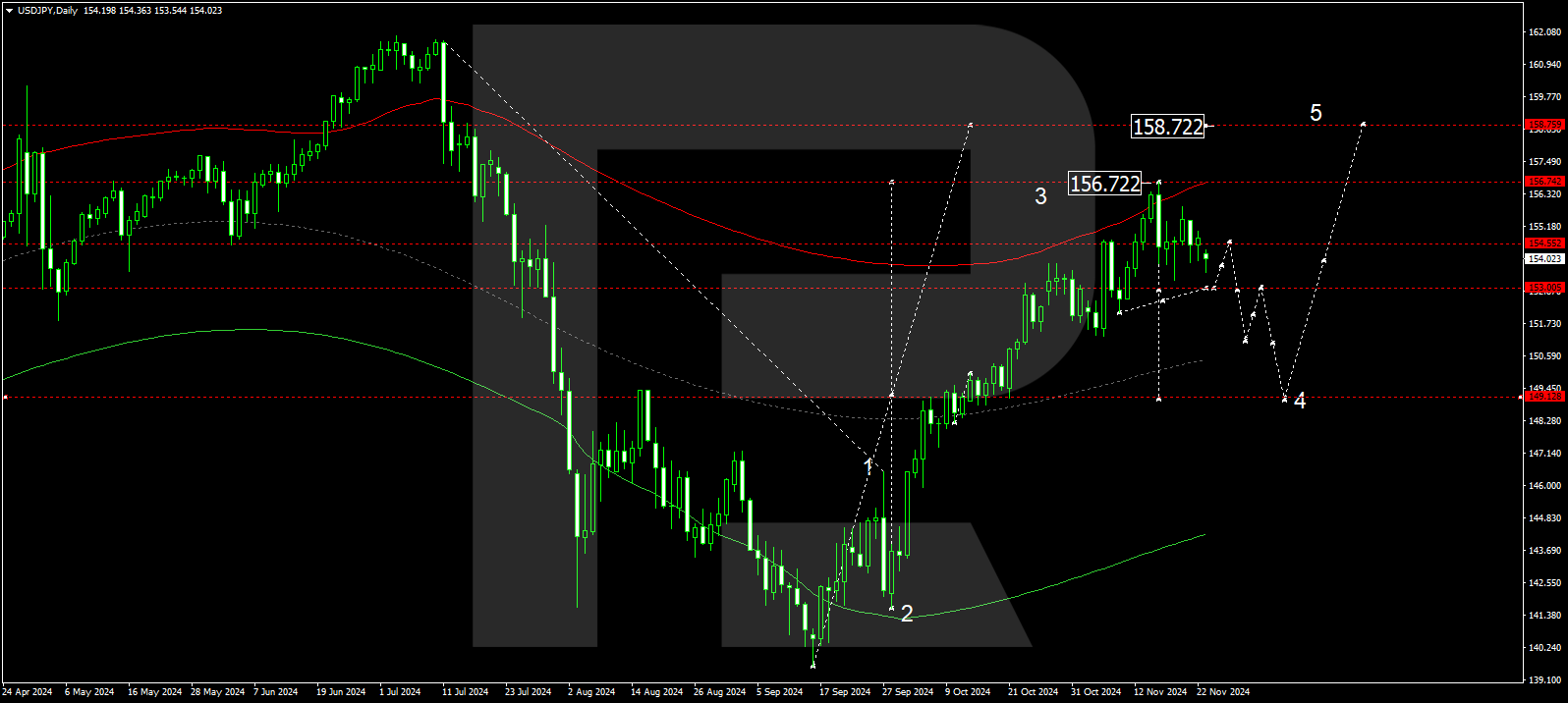

USDJPY forecast

The USDJPY pair is forming the structure of the first downward wave, targeting 153.00. After reaching this level, the price could rise to 154.55, creating a consolidation range around 155.55. A downward breakout should be considered, leading to a corrective wave targeting 151.00 and potentially extending to 149.15. Once the correction is complete, a new growth wave in the USDJPY pair is expected, targeting 158.72.

GBPUSD forecast

The GBPUSD pair has completed the structure of the first downward wave, reaching 1.2480. A correction is likely to follow. A growth structure is expected to form, targeting 1.2780 as the initial target. After reaching this target, the price could decline to 1.2600 (testing from above). Subsequently, the growth wave might extend towards 1.2833, with the correction potentially continuing towards 1.2960, the estimated target.

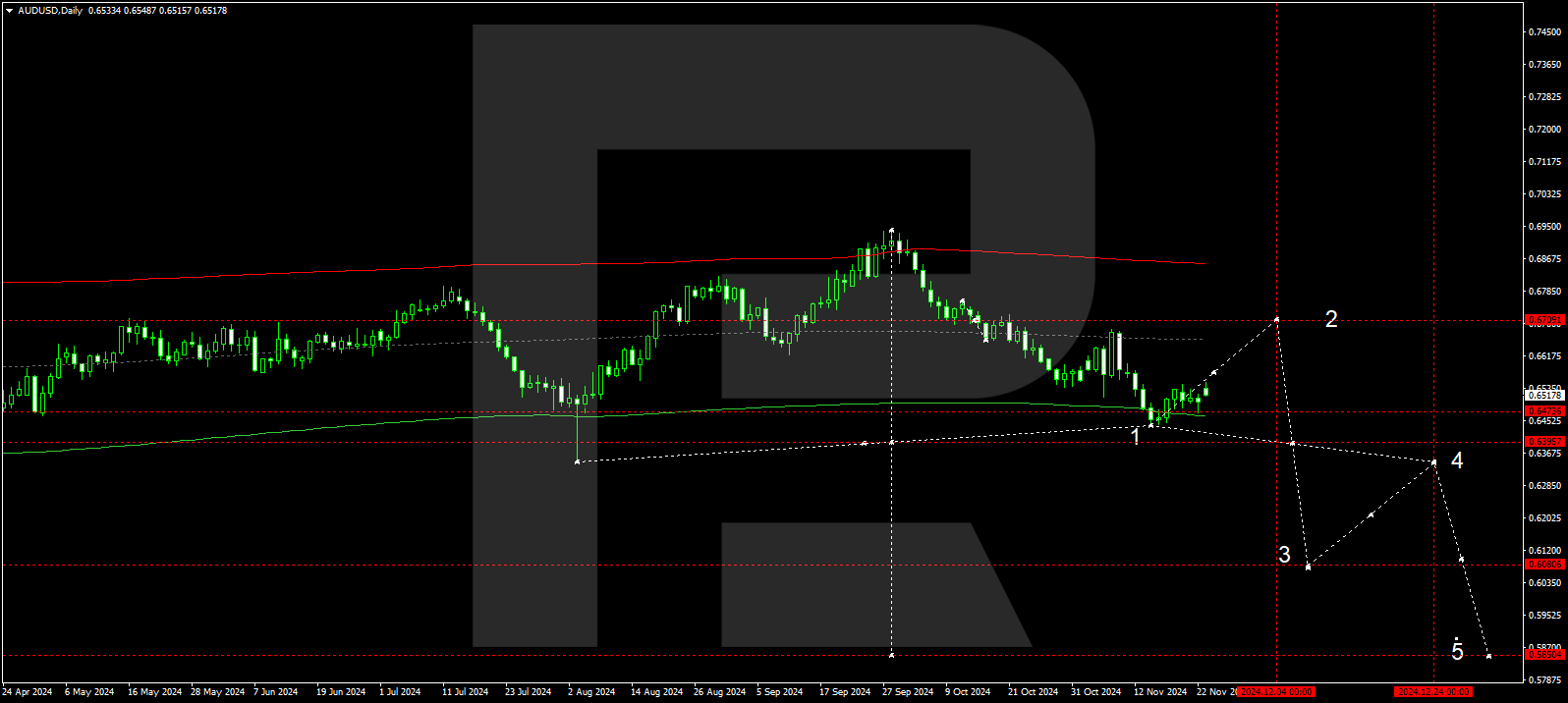

AUDUSD forecast

The AUDUSD pair has formed a downward wave structure towards 0.6444 and completed a growth wave at 0.6548. This marks the beginning of a more substantial correction. A decline towards 0.6474 is expected today, followed by a potential growth wave targeting 0.6575 and potentially extending to 0.6666, the local target.

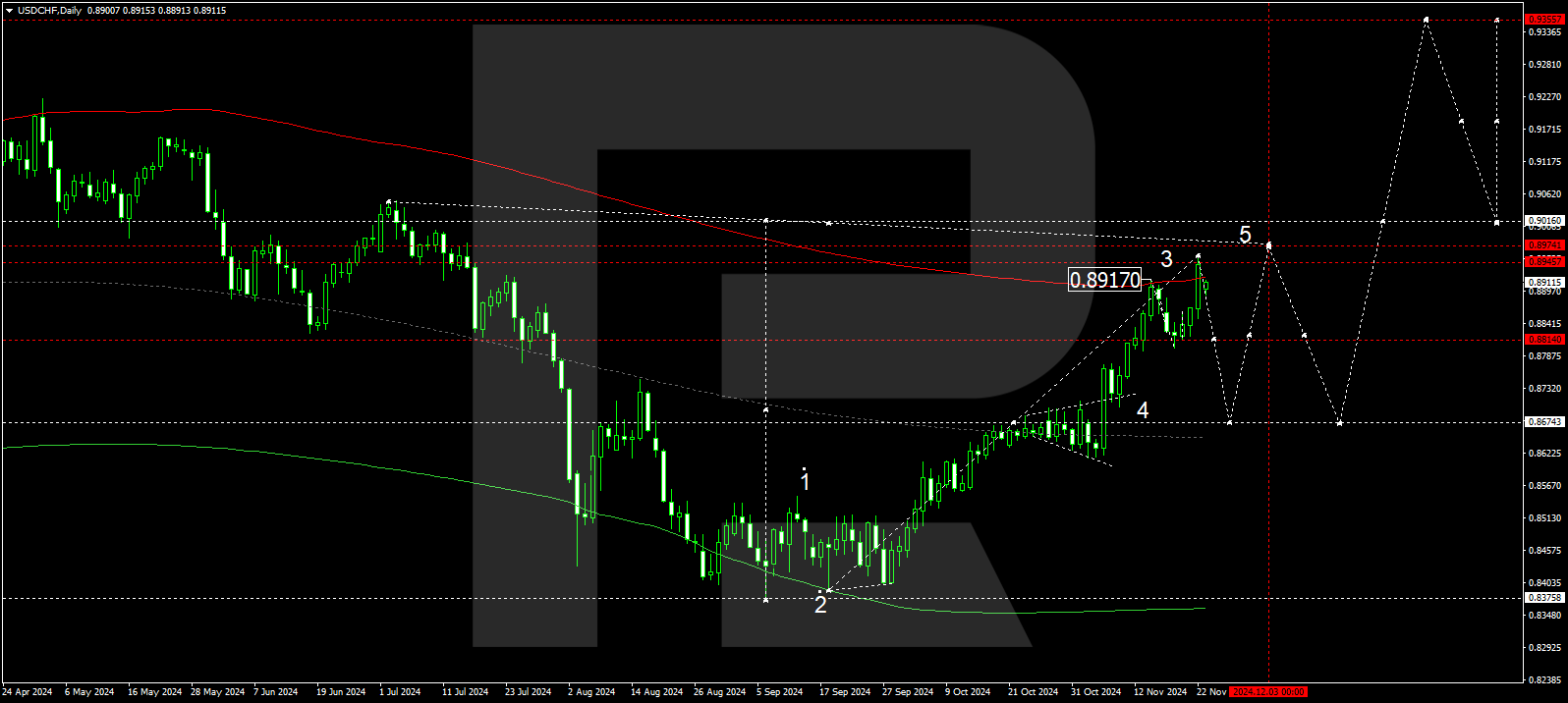

USDCHF forecast

The USDCHF pair has completed a growth wave, reaching the local target of 0.8950. A correction could begin today, aiming for 0.8814. After reaching this level, the price might rise to 0.8880. Subsequently, another downward wave could develop towards 0.8730, with the correction potentially continuing towards 0.8676, the estimated target. Once the correction is complete, a new growth wave in the USDCHF pair will aim at 0.8975, the main target.

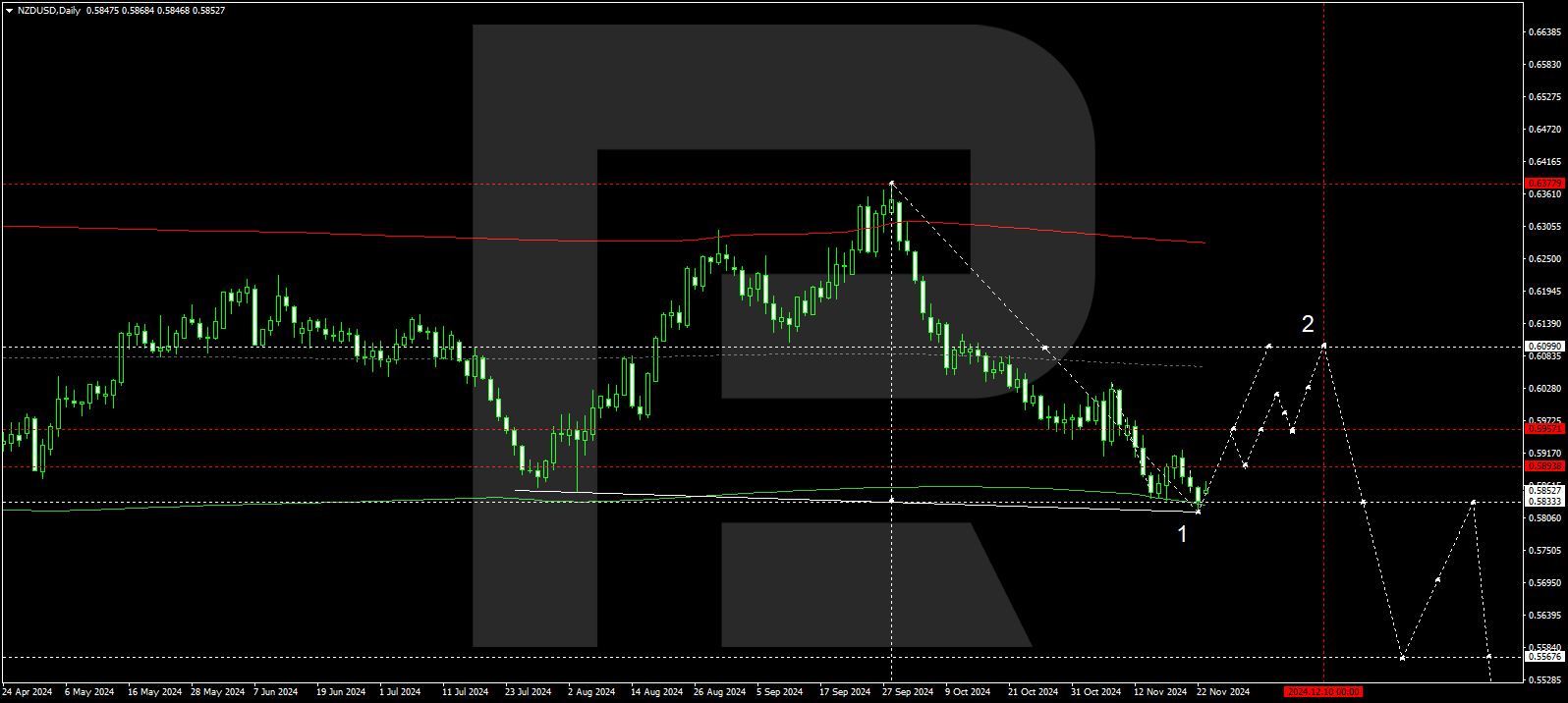

NZDUSD forecast

The NZDUSD pair has completed the first downward wave, reaching 0.5818. A consolidation range might develop at the current lows today. Following an upward breakout, a growth wave towards 0.5957 is anticipated. After reaching this level, the price could fall to 0.5890. Subsequently, the growth wave might extend towards 0.6000, potentially continuing to 0.6090, the estimated target. This growth wave in the NZDUSD pair will be considered a correction of the previous downward wave.

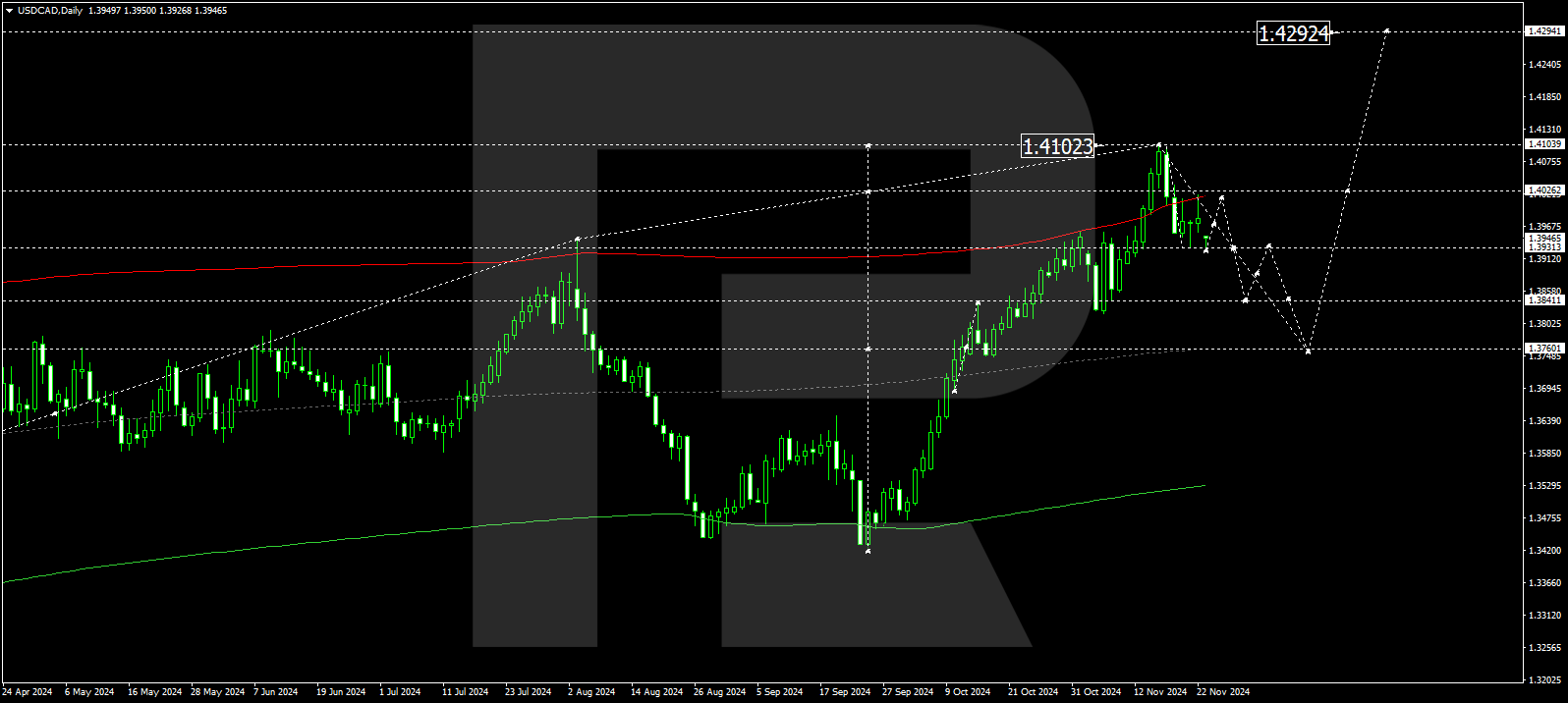

USDCAD forecast

The USDCAD pair has completed a growth wave, advancing to 1.4100. Currently, the structure of the first downward wave is forming, targeting 1.3900. After reaching this level, the price might rise to 1.4000. Subsequently, a new downward wave could develop, targeting 1.3840 and possibly extending to 1.3760, the estimated target. The entire downward wave is considered a correction of the previous growth wave. Once this correction is concluded, a new growth wave in the USDCAD pair is expected to reach 1.4290, the local target.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้