USDJPY: the yen may continue to lose ground

The increase in US building permits and a Fed official’s speech may support the US dollar. Discover more in our analysis for 19 November 2024.

USDJPY forecast: key trading points

- US Housing Starts in October: previously at 1.354 million, projected at 1.340 million

- US building permits in October: previously at 1.425 million, projected at 1.440 million

- Speech by Federal Reserve official Jeffrey Schmid

- USDJPY forecast for 19 November 2024: 157.60

Fundamental analysis

Housing Starts, representing the total number of projects initiated during the reporting month, are compiled from surveys of property owners and construction companies. These statistics cover approximately 95% of all housing projects in the country. The data are adjusted for seasonal factors and weather conditions to improve accuracy.

This indicator is published during the second ten-day period of each month as part of the general construction report, including data on building permits and completed projects. According to the fundamental analysis for 19 November 2024, construction activity may decline to 1.340 million from the previous reporting period. However, this decrease is not critical and is unlikely to impact the USDJPY rate.

Building permits reflect the seasonally adjusted number of permits issued to start new projects. These figures represent an annualised housing construction rate and should be interpreted as the projected number of permits for the year if current trends persist. This indicator is considered a vital metric of the housing market and a reflection of the overall state of the economy. As a leading metric for one of the most critical economic sectors, building permits provide insight into broader economic trends. The forecast for 19 November 2024 anticipates an increase in issued building permits to 1.440 million. Although the rise is modest, it is a positive factor for the US dollar.

Fed official Jeffrey Schmid, the CEO of the Federal Reserve Bank of Kansas City, is scheduled to deliver a speech by the end of the US trading session. His report may include data on the near-term development of the US monetary policy.

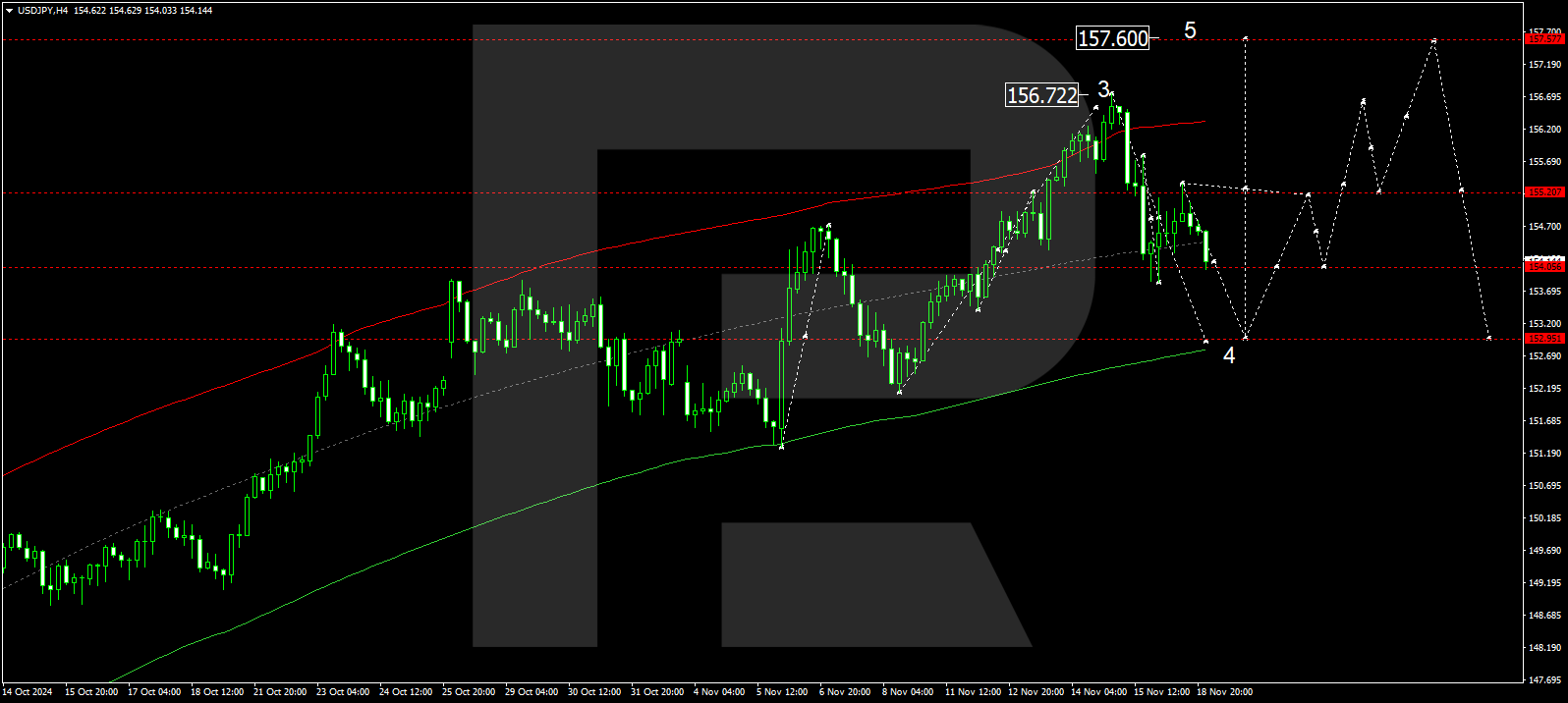

USDJPY technical analysis

The USDJPY H4 chart shows that the market has formed a consolidation range around 154.80. The price is expected to decline to 153.00 today, 19 November 2024, before rising to 154.80. The market will define the boundaries of this consolidation range. A breakout below the range may extend the correction towards 151.30, while an upward breakout could initiate a growth wave towards 157.60, the first target. After reaching this level, the price may undergo a more substantial correction, aiming for 151.30.

The Elliott Wave structure and growth wave matrix, with a pivot point at 153.00, technically support this scenario for the USDJPY rate. The market is forming a consolidation range around the central line of a price envelope. A breakout below the range may extend the correction to the envelope’s lower boundary at 153.00. Conversely, an upward breakout could drive a growth wave targeting the envelope’s upper boundary at 157.60.

Summary

Alongside technical analysis for today’s USDJPY forecast, the stabilising US construction sector supports the likelihood that the correction is complete, with a growth wave continuing towards the 157.60 level.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้