USDCAD: the pair continues to reach new highs

The latest data from the US indices suggest that the US dollar is likely to strengthen further. Discover more in our analysis for 13 November 2024.

USDCAD forecast: key trading points

- The Thomson Reuters/Ipsos Primary Consumer Sentiment Index: previously at 48.41

- US core Consumer Price Index (CPI) (m/m) in October: previously at 0.3%, projected at 0.3%

- US core Consumer Price Index (CPI) (y/y): previously at 3.3%, projected at 3.3%

- US CPI (m/m): previously at 0.2%, projected at 0.2%

- USDCAD forecast for 13 November 2024: 1.4040

Fundamental analysis

The Thomson Reuters/Ipsos Primary Consumer Sentiment Index measures consumer sentiment based on a target group survey. The index fell to 48.41 last month, indicating negative consumer sentiment. Given that the index has declined over the past three months, the forecast for 13 November 2024 may be unfavourable for the Canadian dollar as the actual reading may fall again.

The CPI reflects changes in consumer prices of goods and services and is a key indicator for the direction of purchases and US inflation. Readings below the forecast are considered negative for the US dollar, while stronger-than-expected figures are considered positive.

The CPI is forecast to remain unchanged at 0.3% month-on-month and 3.3% year-on-year. Expectations that the estimates will align with actual data are low so far. A better-than-expected performance in US fundamental indicators could further boost the USDCAD rate.

Fundamental analysis for 13 November 2024 indicates that the US CPI (m/m) is projected to remain at last month’s level of 0.2%. While such figures are encouraging for the national currency, they are not yet indicative of a significant positive shift.

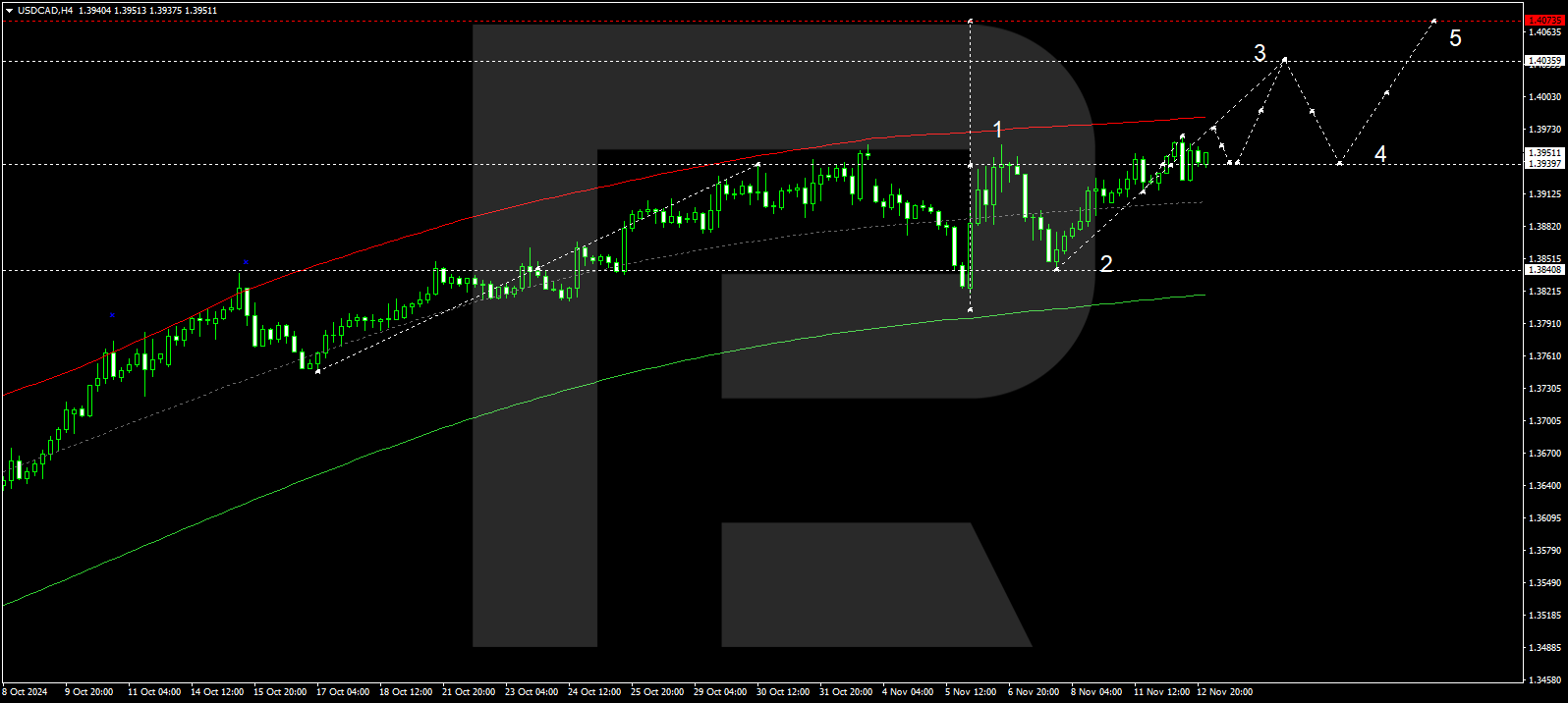

USDCAD technical analysis

The USDCAD H4 chart shows that the market is forming a consolidation range around 1.3939. The price is expected to break above the range today, 13 November 2024, aiming for 1.4040 as the local target. A correction could follow once the price hits this level, targeting 1.3939 (testing from above). Subsequently, another growth wave might develop, aiming for 1.4074.

The Elliott Wave structure and wave matrix, with a pivot point at 1.3939, technically confirm this scenario. This level is considered crucial for the third growth wave in the USDCAD rate. The market is forming a growth matrix structure towards the upper boundary of a price envelope at 1.4040. A correction is possible after the price reaches this level, aiming for the envelope’s central line at 1.3939. Subsequently, a new growth matrix could follow, targeting its upper boundary at 1.4074.

Summary

The latest date from the US indices could positively impact the US dollar. Given the technical analysis for today’s USDCAD forecast and the US indices data, the growth wave may continue towards the 1.4040 level.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้