USDJPY holds steady ahead of the Bank of Japan meeting

The USDJPY pair is hovering around 155.80, with the market focus on the future BoJ interest rate decision. Discover more in our analysis for 22 January 2025.

USDJPY forecast: key trading points

- The USDJPY pair is subdued, awaiting news

- The market forecasts a Bank of Japan interest rate hike at the upcoming meeting

- USDJPY forecast for 22 January 2025: 155.85 and 156.59

Fundamental analysis

The USDJPY rate stands at 155.80 on Wednesday. The Japanese yen has paused its recent rally as investors conserve their strength for future movements. Market attention is focused on the upcoming Bank of Japan meeting this week.

Supported by hawkish statements from certain monetary policymakers, baseline stock market expectations indicate that the BoJ will increase the interest rate. The rate hike would raise Japan’s short-term borrowing costs to 0.5%, marking the highest level since the 2008 financial crisis.

The Bank of Japan meeting is more crucial than external events. The US dollar is in a weak position, as the excitement over trade tariffs and inflation stabilisation offers little support to the US currency.

The USDJPY forecast appears neutral.

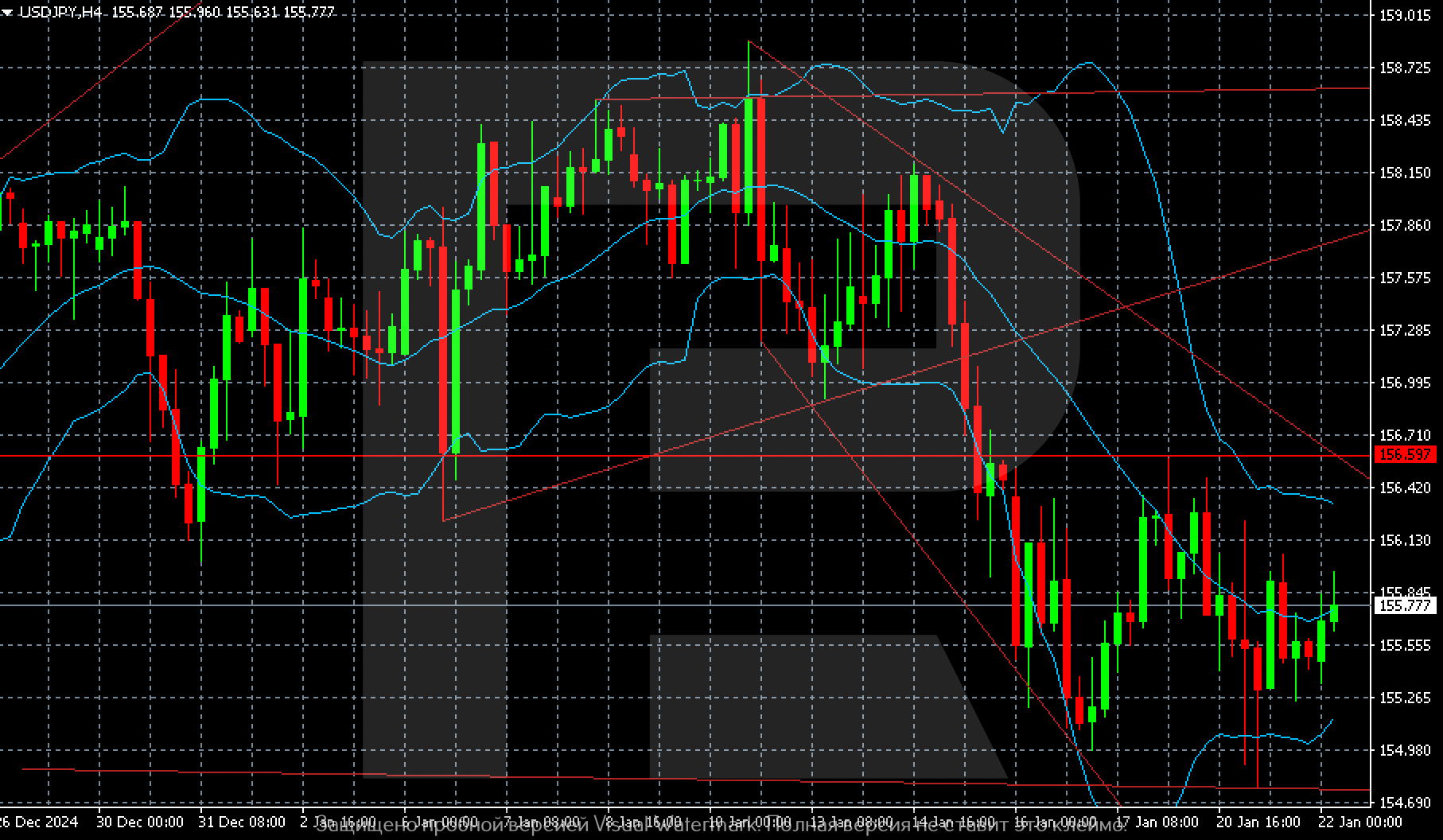

USDJPY technical analysis

On the USDJPY H4 chart, the main scenario for today is a sideways range between 154.69 and 156.59. Market interest is concentrated around the 155.70 level. If the price consolidates above 155.85, it may pave the way for an advance towards the upper boundary of the sideways range at 156.59.

The picture remains uncertain.

Summary

The USDJPY pair is in equilibrium. The stock market’s focus is firmly on the Bank of Japan’s interest rate decision. While each policy adjustment presents challenges for the regulator, current inflation levels allow for tighter monetary conditions. The USDJPY forecast for today, 22 January 2025, suggests that the pair could remain in a sideways range, with prices stabilising near the 155.70 level.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้