USDJPY: the pair is consolidating above 157.00

The USDJPY rate continues to trade within a limited range, holding steady above 157.00. Today, market participants are awaiting US inflation statistics. More details in our analysis for 14 January 2025.

USDJPY forecast: key trading points

- The Eco Watchers Survey indicator (measuring short-term economic trends in Japan’s regions) rose to 49.9 points in December 2024 from 49.4 in November

- The PPI – an indicator for US inflation trends – will be published today

- USDJPY forecast for 14 January 2025: 158.88 and 157.00

Fundamental analysis

The USDJPY has paused its upward momentum and is now consolidating within a limited range above 157.00. Bank of Japan Deputy Governor Ryozo Himino stated that the regulator’s Board will discuss an interest rate hike next week. He also noted that price trends and inflation expectations generally align with forecasts. However, domestic and global risk factors persist.

Market participants are awaiting US inflation statistics today, with the Producer Price Index (PPI) scheduled for release. It is expected to rise by 0.3% month-on-month and 3.4% year-on-year. Weaker-than-forecast data could weigh on the USD and push the pair lower. Conversely, stronger figures will support the US dollar, helping strengthen the USDJPY rate.

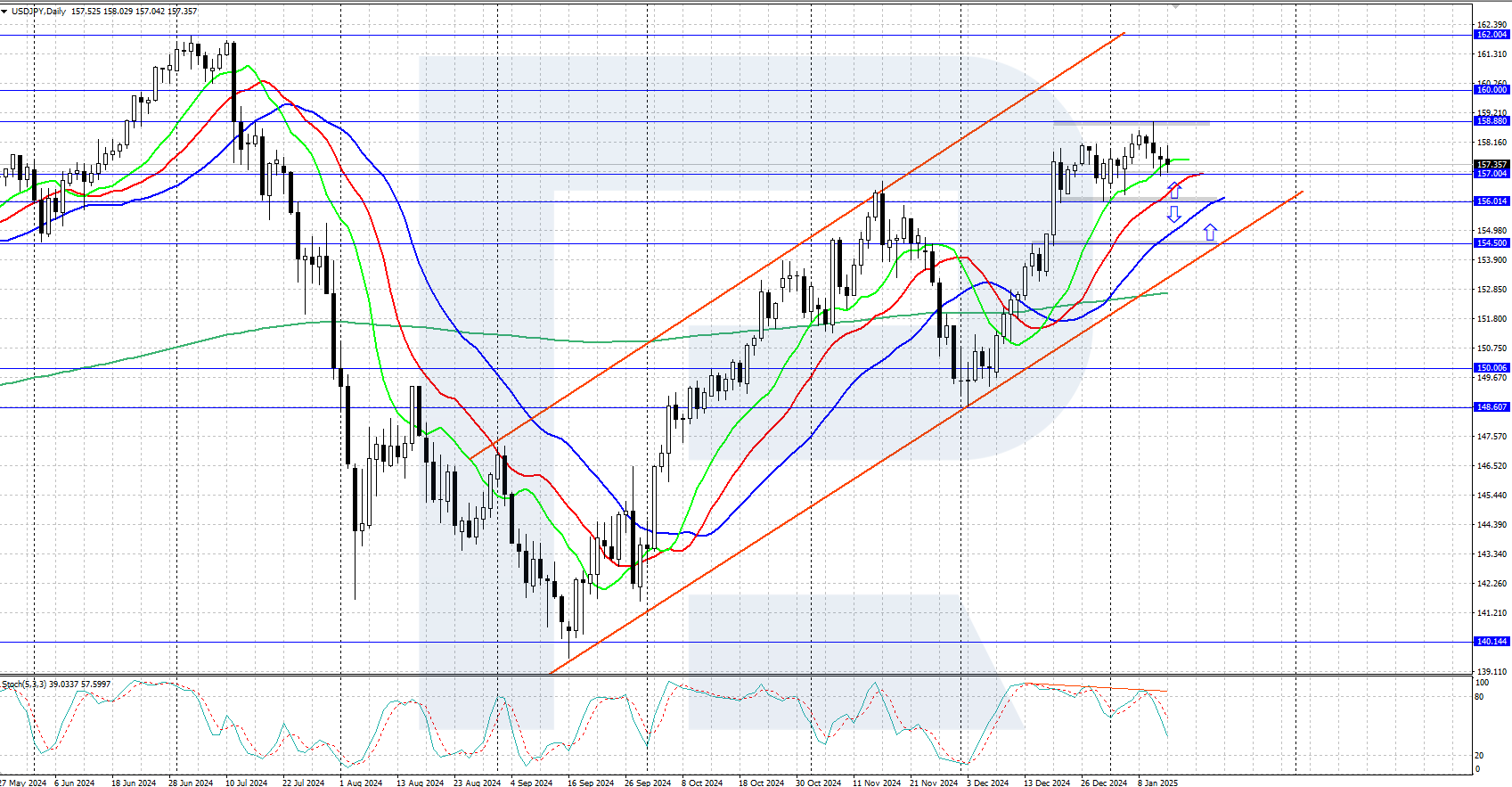

USDJPY technical analysis

On the H4 chart, the USDJPY pair is consolidating between 156.00 and 158.88 following an upward movement. The daily trend in the pair is upward and is confirmed by the Alligator indicator. However, there are risks of a downward correction, with the Stochastic indicator signalling a decline – a bearish divergence.

Today’s USDJPY forecast suggests that if the bulls manage to hold the quotes above the key support level of 157.00, the pair may climb towards the 158.88 resistance level and beyond. Conversely, if the bears overcome the support at 157.00, the price could retrace to 156.00 and potentially further to 154.50.

Summary

The USDJPY pair has paused its upward momentum and is now consolidating between 156.00 and 158.88. US inflation data may drive volatility during the American sedssion when the PPI is released.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้