USDJPY: uncertainty in the BoJ actions weakens the Japanese yen

The USDJPY rate reversed from the support level, with the current price at 156.55. Discover more in our analysis for 23 December 2024.

USDJPY forecast: key trading points

- The Japanese yen remains under pressure due to uncertainty regarding a Bank of Japan interest rate hike

- Americans’ income rose by 0.3% in November, with spending increasing by 0.4%

- The core US PCE Price Index increased by 2.8% year-on-year

- USDJPY forecast for 23 December 2024: 157.85 and 160.15

Fundamental analysis

The USDJPY rate rises on Monday, holding above the key resistance level at 155.95. The Japanese yen remains under pressure amid persistent uncertainty regarding the timing of a potential BoJ interest rate hike.

Last week, the Bank of Japan kept the rate unchanged, citing the need to carefully analyse wage changes, global economic uncertainties, and the impact of the new US administration on the economy.

Meanwhile, Americans’ incomes increased by 0.3% from October, while spending rose by 0.4%. Analysts had forecasted higher figures of 0.4% and 0.5%, respectively.

The core PCE Price Index, closely monitored by the Federal Reserve to assess inflation risks, increased by 2.8% year-on-year, unchanged from the October reading. This is the most substantial growth since April; experts had expected it to accelerate to 2.9%. Today’s USDJPY forecast suggests that robust US inflation data will help strengthen the US dollar.

USDJPY technical analysis

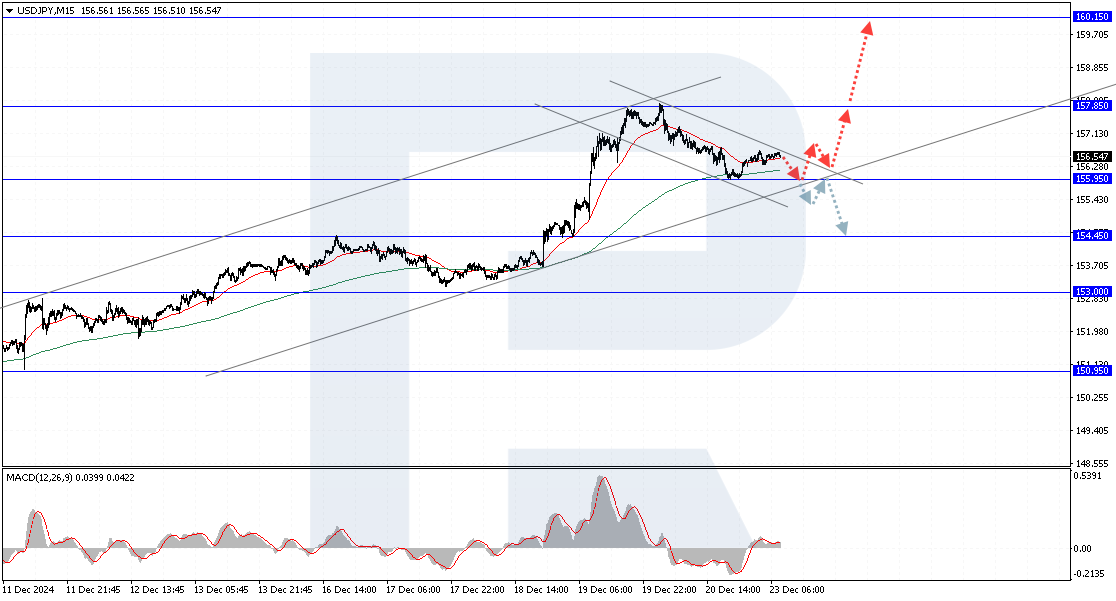

The USDJPY rate is moving within a bullish correction but remains within the uptrend. Today’s USDJPY forecast suggests a test of the 155.95 support level, potentially followed by a rise to 157.85. A breakout above a local high and a consolidation above this level will pave the way for buyers to reach 160.15. A surge in the USDJPY rate will be further confirmed by a breakout above the upper boundary of the descending channel, with the price securing above 156.65. The bullish scenario could be invalidated if the price breaks below the lower boundary of the ascending channel and consolidates below 155.95, indicating further downward momentum towards 154.45.

Summary

Strong US inflation data strengthens the US dollar, supporting growth in the USDJPY pair. The Japanese yen continues to weaken amid persistent uncertainty in the Bank of Japan’s monetary policy. The USDJPY technical analysis indicates the potential for US dollar growth if the price breaks above the upper boundary of the descending channel and secures above the 156.65 level. However, the bullish scenario could be invalidated if the price breaks below the lower boundary of the ascending channel and consolidates below the 155.95 level.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้