USDCAD temporarily declines, but the CAD forecast remains bearish

The USDCAD pair begins the week with a decline to 1.4448. This does not change the trend, but the market needs a pause. Find out more in our analysis for 20 January 2025.

USDCAD forecast: key trading points

- The USDCAD pair has paused its growth, but only temporarily

- The threat of US trade tariffs and uncertainty surrounding the Bank of Canada’s interest rate decisions are weighing on the CAD rate

- USDCAD forecast for 20 January 2025: 1.4463 and 1.4485

Fundamental analysis

The USDCAD rate is moderately correcting, falling to 1.4448.

However, this does not hinder the long-term uptrend. The Canadian dollar is nearing its multi-year low, tested in December. The market’s heightened attention to US trade tariffs, particularly after Donald Trump’s inauguration, makes this issue more critical. If the US imposes stringent trade tariffs, it will negatively impact Canada, forcing the country to respond with countermeasures.

On Monday, the Bank of Canada will publish its Q4 2024 Business Outlook Survey. This release may offer clues regarding the regulator’s interest rate actions at the end of January. The report is expected to be more structured and summarised, providing a clearer picture of the Canadian economy’s future.

The USDCAD forecast appears positive.

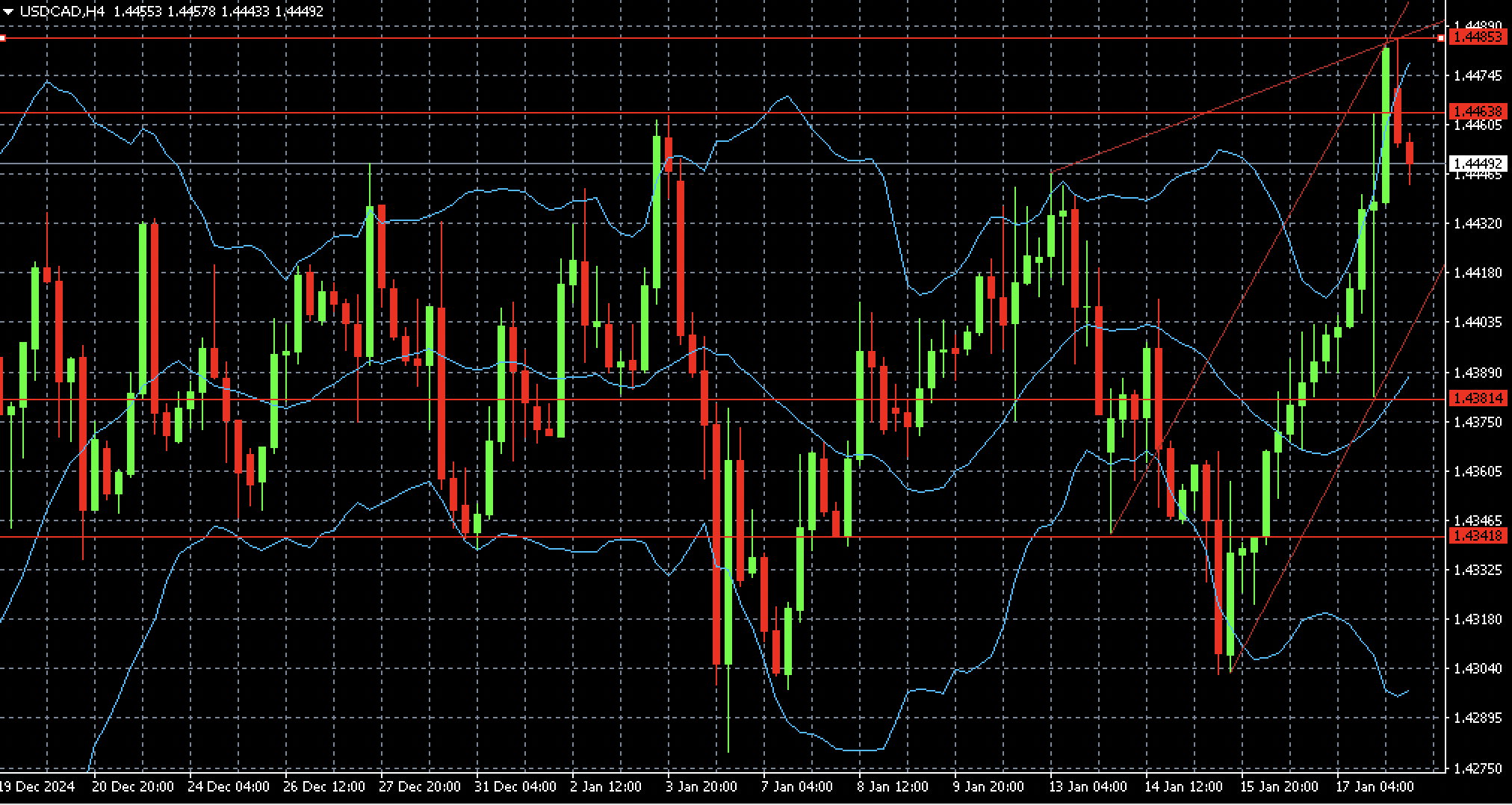

USDCAD technical analysis

The USDCAD H4 chart shows that the price has declined over the last two periods, which is insufficient for a full correction. For the price to reach the intermediate support level at 1.4381, it must first break below 1.4403.

Today, the USDCAD pair may resume its growth after a local decline to 1.4445, with potential growth targets at 1.4463 and 1.4485.

Summary

The USDCAD pair has temporarily paused its growth, but its medium-term outlook remains unchanged. The forecast for today, 20 January 2025, suggests growth will resume after a local correction, with growth targets at the 1.4463 and 1.4485 levels.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้