EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD technical analysis and forecast for 11 - 15 November 2024

Here is a detailed weekly technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD for 11 - 15 November 2024.

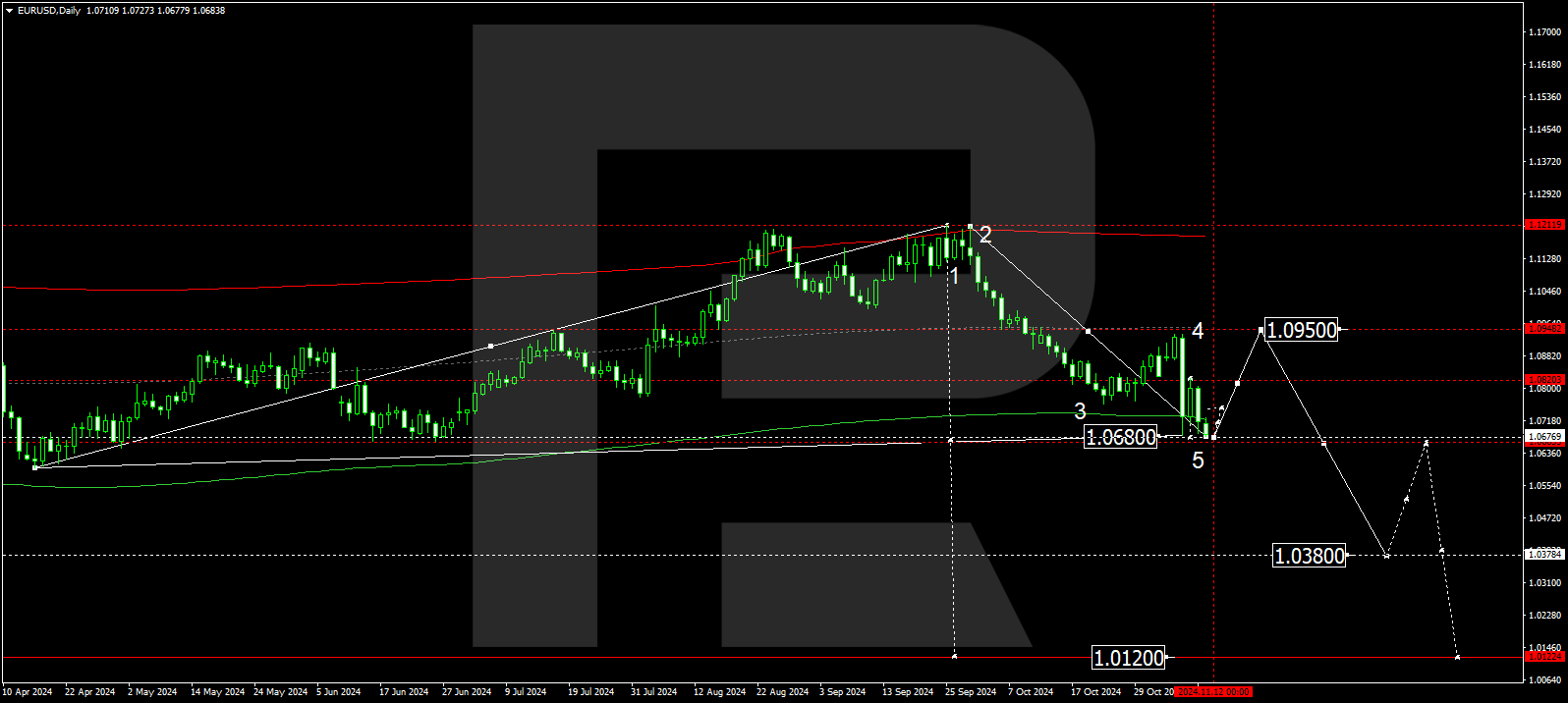

EURUSD forecast

The EURUSD pair has completed a downward wave, reaching 1.0680, the initial target. A consolidation range is expected to form at the low point of this wave. A breakout above this range could initiate a correction towards 1.0950, with the initial target for the correction at 1.0820. Conversely, a breakout below the range could extend the EURUSD pair’s downward wave towards 1.0520 without a correction, potentially reaching the local target of 1.0380.

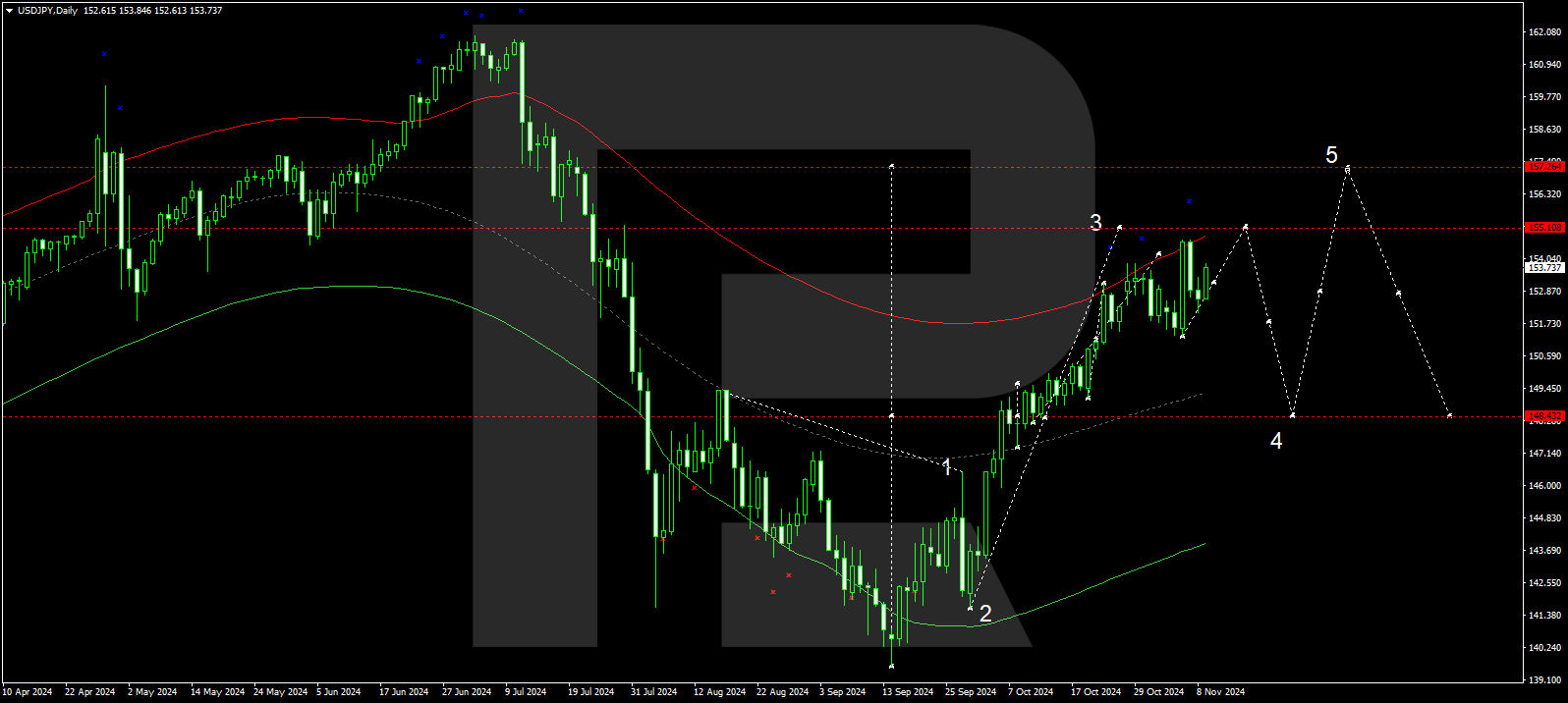

USDJPY forecast

The USDJPY pair is forming a broad consolidation range around 153.20, which could expand to 155.10. Subsequently, the price might decline and break below the range, marking the beginning of a correction towards 148.40, with the initial target at 151.50. If the USDJPY pair breaks above the range without a correction, the upward wave may continue towards its main target of 157.27.

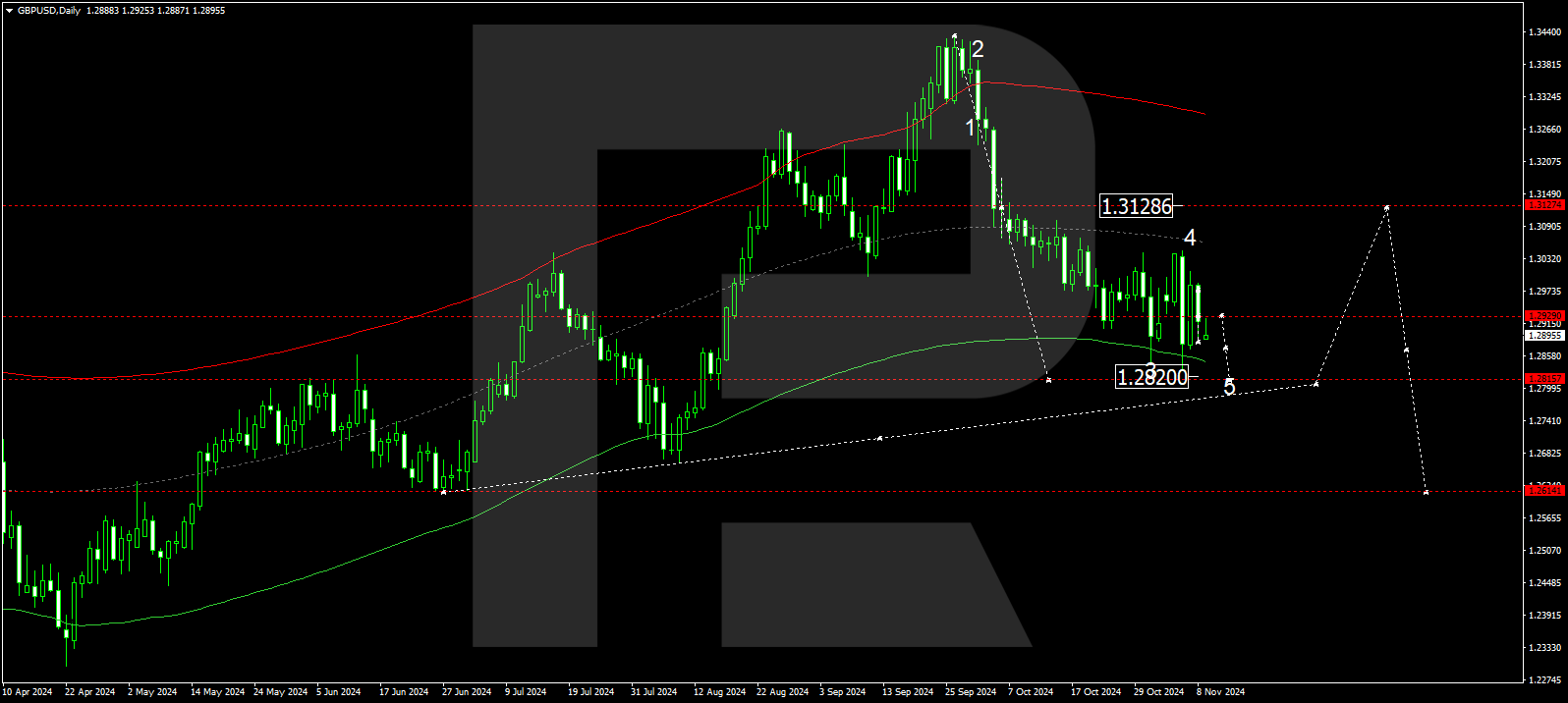

GBPUSD forecast

The GBPUSD pair is forming a broad consolidation range around 1.2929. A decline to 1.2820 is likely as the initial target. After the price reaches this level, a growth wave is expected, aiming for 1.3127, with the first target at 1.2966. If the price rebounds from the 1.2929 level and breaks below the range, the downward wave could continue towards 1.2740 without a correction, potentially extending to the local target of 1.2614.

AUDUSD forecast

The AUDUSD pair is forming a wide consolidation range around 0.6580. A downward wave is expected to develop, targeting 0.6494. Once the price reaches this level, an upward wave may begin, aiming for 0.6680, with the first target at 0.6580. If the price rebounds from 0.6580 and breaks below the range, the AUDUSD pair may continue its downward momentum towards 0.6400 without a correction, potentially extending to the local target of 0.6222.

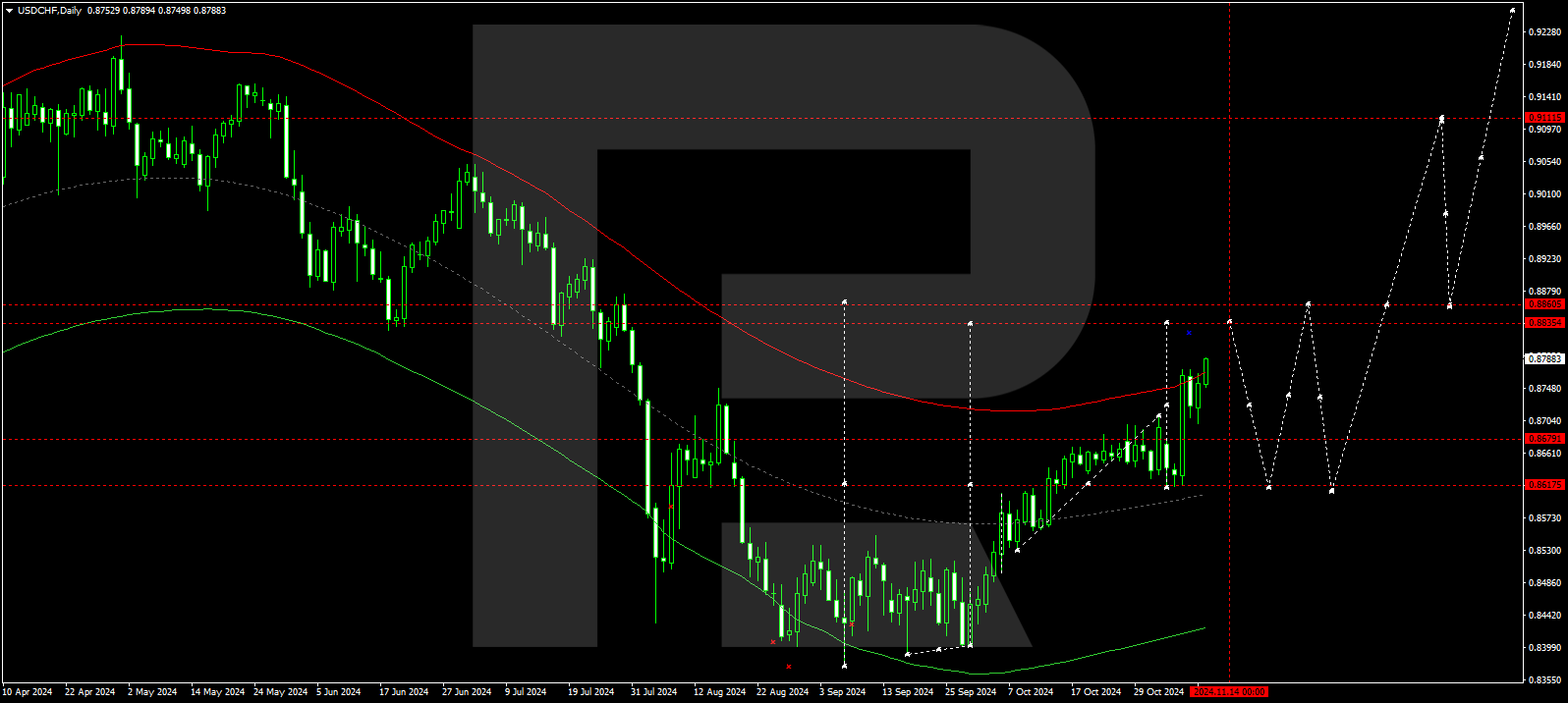

USDCHF forecast

The USDCHF pair has broken above 0.8770, with the market considering a potential continuation of the third growth wave towards the local target of 0.8835. After reaching this level, the price could correct towards 0.8616, with the first target at 0.8727. If the price rebounds from 0.8770 and breaks above 0.8800, the USDCHF pair could continue moving towards 0.8880, potentially advancing to the 0.9111 level.

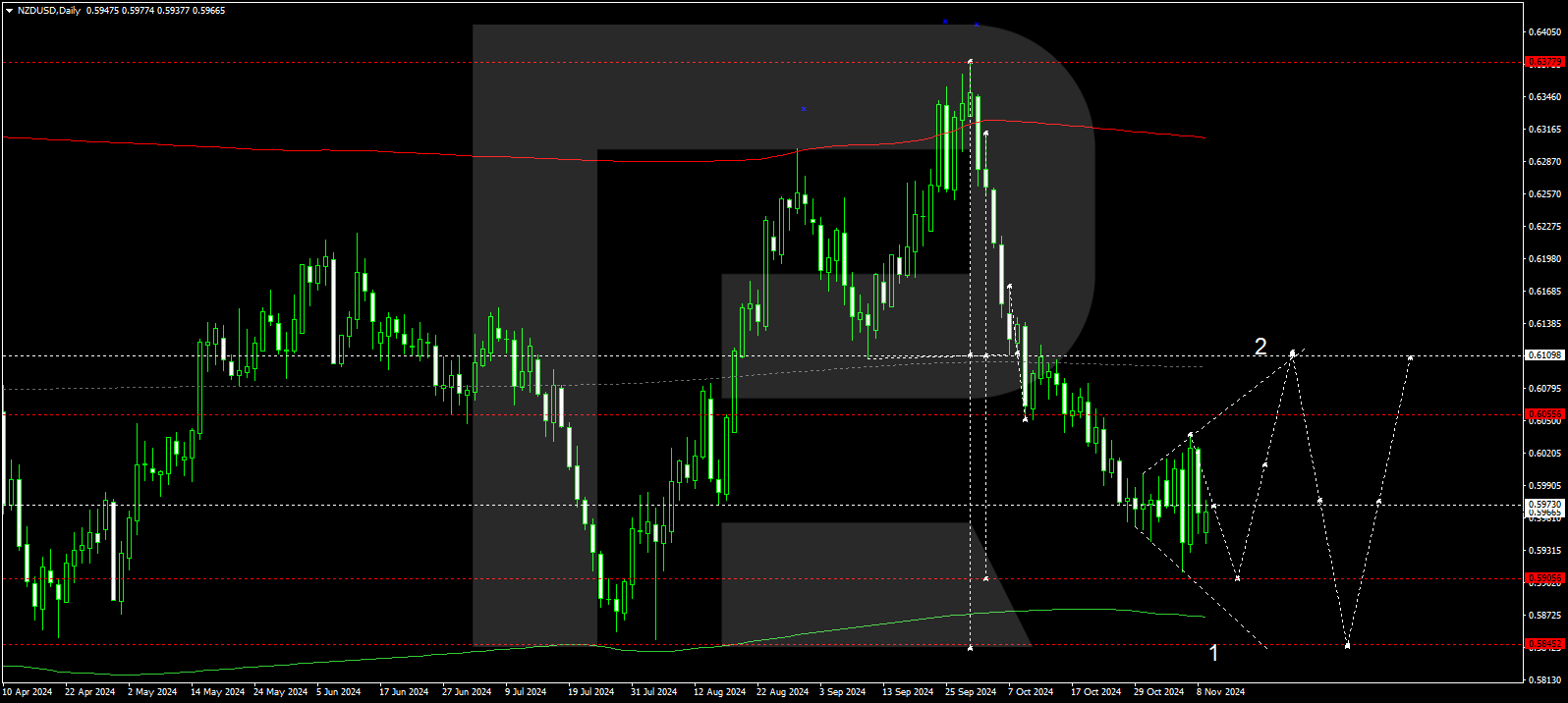

NZDUSD forecast

The NZDUSD pair is forming a broad consolidation range around 0.5973. A downward wave is expected to develop towards 0.5900. After the price reaches this level, an upward wave may begin, aiming for 0.6100, with the initial target at 0.6020. If the price rebounds from 0.5973 and breaks below 0.5900, the NZDUSD pair could continue its downward trend towards 0.5840 without a correction.

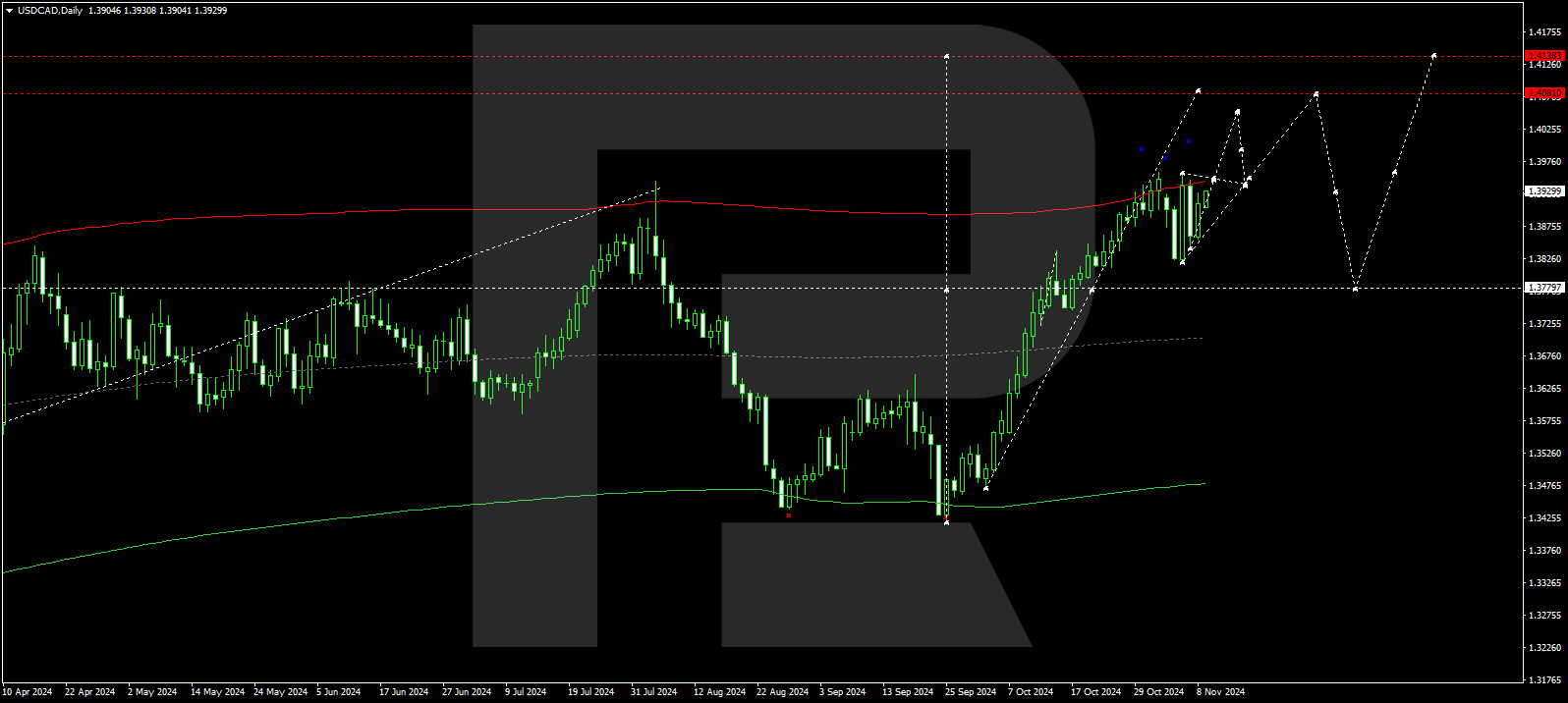

USDCAD forecast

The USDCAD pair continues to develop a broad consolidation range around 1.3850. A breakout to the downside could lead to a correction towards 1.3650, with the initial target at 1.3777. If the price rebounds from 1.3850 and breaks above 1.3900, the USDCAD pair could maintain its upward trajectory towards 1.4080 and potentially advance to the main target of 1.4140 without a correction.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้