GBPUSD stabilised: all news factored into prices

The GBPUSD pair started the week in calm conditions. The pound has absorbed the recent shock and recovered. Find out more in our analysis for 11 November 2024.

GBPUSD forecast: key trading points

- The GBPUSD pair has stabilised

- The market expects the Bank of England to reduce interest rates gradually

- GBPUSD forecast for 11 November 2024: 1.2850 and 1.2820

Fundamental analysis

The GBPUSD rate is hovering around 1.2910 on Monday.

The market is awaiting new data for further insights into the UK’s economic and inflation outlook.

The baseline forecast suggests that the Bank of England’s interest rate trajectory will exceed the Federal Reserve’s. By the BoJ’s meeting on 10 December 2025, borrowing costs could average 4.1% per annum. This target implies a relatively brisk pace of rate cuts, but certainly not above the Fed.

The spread between the Bank of England and the US Federal Reserve’s interest rate approaches could support GBPUSD’s position until the end of the year. This expectation becomes even more relevant if the agenda of the elected US President, Donald Trump, proves as inflationary as markets anticipate.

The GBPUSD forecast is currently neutral.

GBPUSD technical analysis

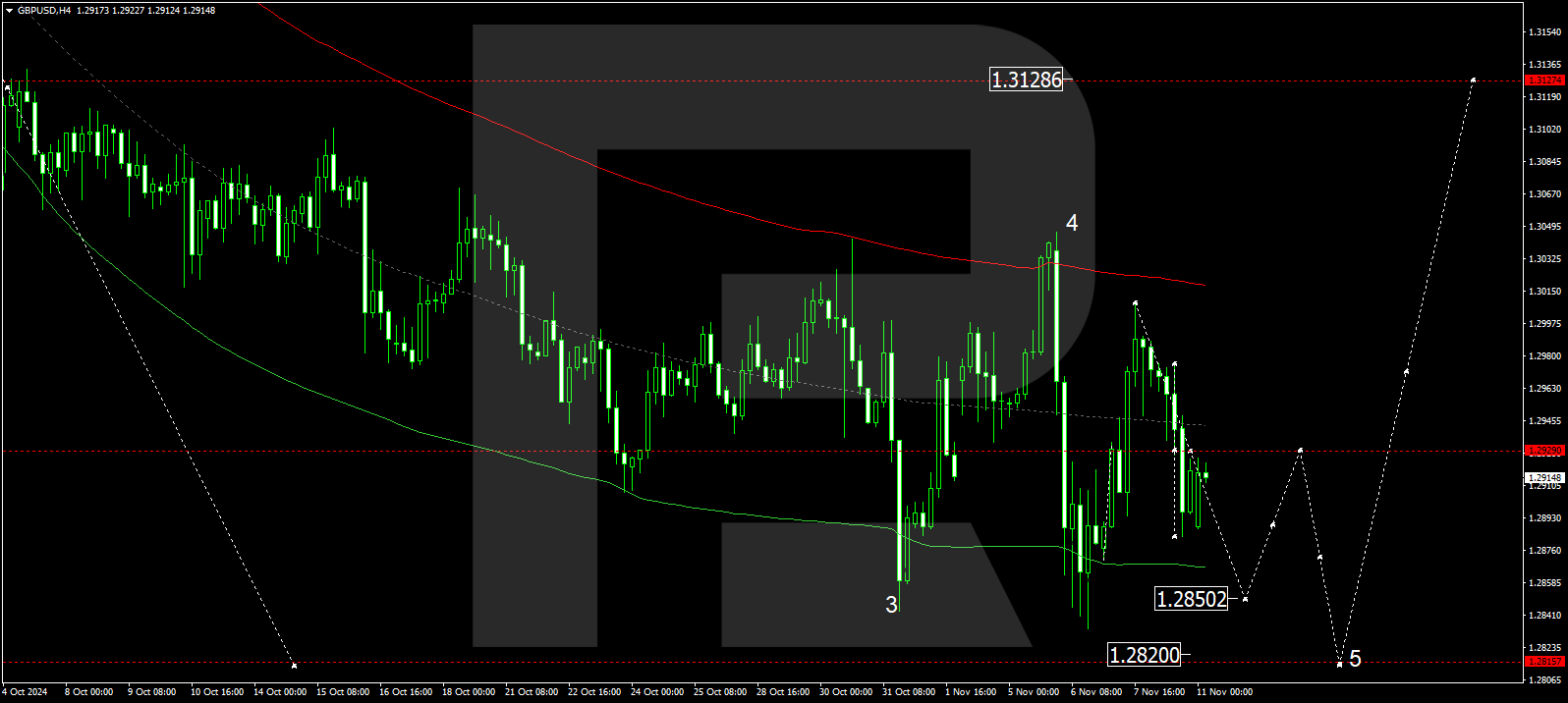

The GBPUSD H4 chart shows the market is forming a consolidation range around 1.2929, potentially extending to 1.2850 today, 11 November 2024. Subsequently, the price could rise to 1.2929 (testing from below). The downward wave may extend towards the main target of 1.2820. Once the price hits this level, a new growth wave could start, aiming towards 1.3131, with a first target at 1.2780.

The Elliott Wave structure and wave matrix, with a pivot point at 1.2929, technically confirm this scenario for the GBPUSD rate. The market continues to decline towards the envelope’s lower boundary, targeting 1.2850. After reaching this level, the price could rise to the midpoint of the price envelope at 1.2929 before falling back to the envelope’s lower boundary at 1.2820.

Summary

The GBPUSD pair declined and returned to equilibrium. Investors need updated data. Technical indicators for today’s GBPUSD forecast suggest that the downward wave may continue towards the 1.2850 and 1.2820 levels.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้