EURUSD under pressure: the US labour market remains resilient

The EURUSD rate declined after rising in the last trading session, with its current price at 1.0411. More details in our analysis for 27 December 2024.

EURUSD forecast: key trading points

- The markets are pricing in a 35-basis-point Federal Reserve rate cut in 2025

- US initial jobless claims decreased to 219 thousand, reaching the lowest level in a month

- Labour market data confirms its resilience, justifying the Fed’s tight monetary policy

- EURUSD forecast for 27 December 2024: 1.0385 and 1.0340

Fundamental analysis

The EURUSD rate is experiencing a slight correction on Friday, remaining below the 1.0425 resistance level. Investors continue to focus on the Federal Reserve’s monetary policy outlook. Last week’s hawkish statements by Fed Chair Jerome Powell, in which he emphasised the prioritisation of inflation control over supporting economic growth, increased uncertainty about the extent of interest rate cuts next year, which supported the US dollar. The markets are currently pricing in a 35-basis-point rate cut in 2025. This indicates that the market is starting to question the Federal Reserve’s aggressive actions and continues to weigh on the euro, as reflected in today’s EURUSD forecast.

US labour market data released on Thursday exceeded expectations. Initial jobless claims fell to a monthly low, indicating some cooling in the labour market. However, it remains resilient, with claims down 1,000 from the previous week, reaching 219 thousand. This data confirms challenges ahead of the new year and appears to align with the recent FOMC signals regarding the serious inflation threat to the economy. Nonetheless, a potential labour market weakening justifies continuing a restrictive monetary policy.

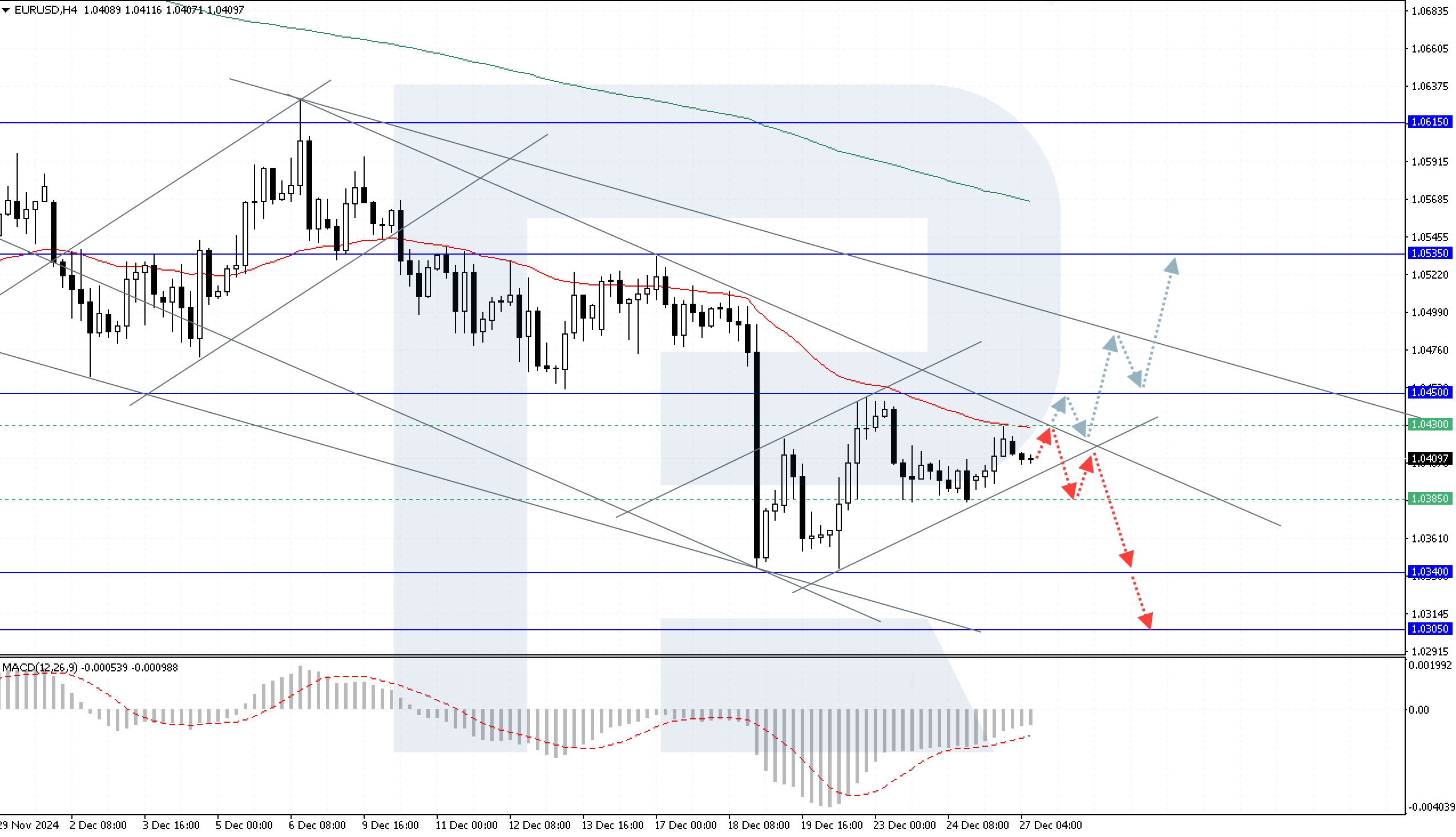

EURUSD technical analysis

The EURUSD quotes are declining after rebounding from the EMA-45, which remains a floating resistance level for market participants. According to today’s EURUSD forecast, the price is expected to test the upper boundary of a descending channel at 1.0430 before dropping to the 1.0385 support level. If the price secures below this level, it could signal a decline to a low of 1.0340. The bullish scenario suggests the price will gain a foothold above the 1.0430 resistance level. In this case, an upward correction towards 1.0480 may follow, and a breakout above this level would indicate a rise to 1.0535.

Summary

The EURUSD rate remains under pressure due to a stronger US dollar position caused by the Federal Reserve’s hawkish statements and uncertainty about interest rate cuts next year. The resilient US labour market reinforces the FOMC’s priority of fighting inflation, which justifies the regulator’s tight monetary policy. The EURUSD technical analysis shows the pair moving within the downtrend, with a key resistance level at 1.0430. The price could decline from this level to the 1.0385 support level and further to 1.0340. If the quotes secure above 1.0430, this will open the way for an upward correction towards the 1.0480 and 1.0535 targets.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้