EURUSD continues to decline: the US dollar strengthened further

The EURUSD pair fell to 1.0504. The market reacted to US inflation data. Find out more in our analysis for 12 December 2024.

EURUSD forecast: key trading points

- The EURUSD pair continues its downward trend

- The US dollar strengthened further following the release of US inflation data

- EURUSD forecast for 12 December 2024: 1.0470 and 1.0440

Fundamental analysis

The EURUSD rate fell to 1.0504 following the November US inflation statistics release. The Consumer Price Index (CPI) rose by 0.3% last month, aligning with expectations, marking the most significant increase since April 2024. The CPI had previously risen by 0.2% for four consecutive months.

Following the release, the likelihood of a US Federal Reserve interest rate cut at the 18 December meeting increased to 94%. The market is almost certain that the rate will be lowered next week.

The EURUSD forecast is negative for the euro.

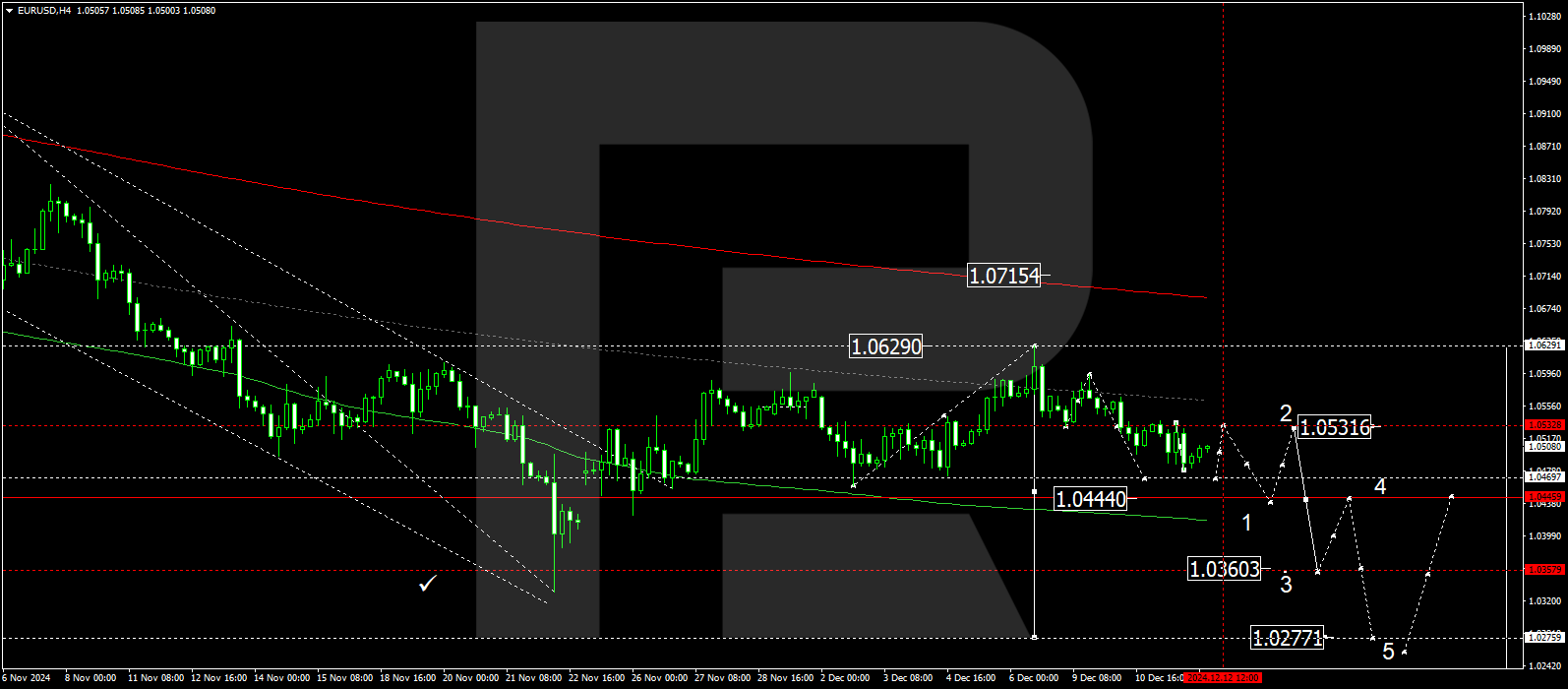

EURUSD technical analysis

The EURUSD H4 chart shows the market has completed a downward wave, reaching 1.0479. A consolidation range may develop around 1.0505 today, 12 December 2024. Subsequently, the price may decline further towards the local target of 1.0470. Once this target is reached, a correction towards 1.0530 (testing from below) is possible, followed by a consolidation range forming around this level. The price is expected to break below the range and extend the wave towards 1.0440, the first estimated target.

The Elliott Wave structure and downward wave matrix, with a pivot point at 1.0533, technically support this scenario. This level is considered crucial for the EURUSD rate. The market continues to develop another downward wave below the central line of a price envelope, which could target its lower boundary at 1.0440.

Summary

The EURUSD pair remains under downward pressure, although the intensity has eased compared to earlier. Technical indicators for today’s EURUSD forecast suggest a potential downward wave towards the 1.0470 and 1.0440 levels.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้