Gold (XAUUSD) reverses upwards, securing above 2,550 USD

XAUUSD prices declined to 2,536 USD within a correction last week, where they encountered strong demand and formed a local upward reversal. More details in our XAUUSD analysis for today, 18 November 2024.

XAUUSD forecast: key trading points

- Market focus: last week’s US inflation data aligned with forecasts

- Current trend: correcting within an uptrend

- XAUUSD forecast for 18 November 2024: 2,536 and 2,600

Fundamental analysis

XAUUSD quotes are trading within a downward correction, but there are signs of its completion and an upward reversal. The US inflation data released last week aligned with forecasts: the Producer Price Index (PPI) showed a 2.4% rise, and the Consumer Price Index (CPI) increased 2.6%.

US home building statistics are expected tomorrow, with building permits and housing starts scheduled for release. Weaker-than-forecast statistics could exert pressure on the US dollar and help strengthen XAUUSD. Conversely, growth would bolster the US dollar and cause prices to decline.

XAUUSD technical analysis

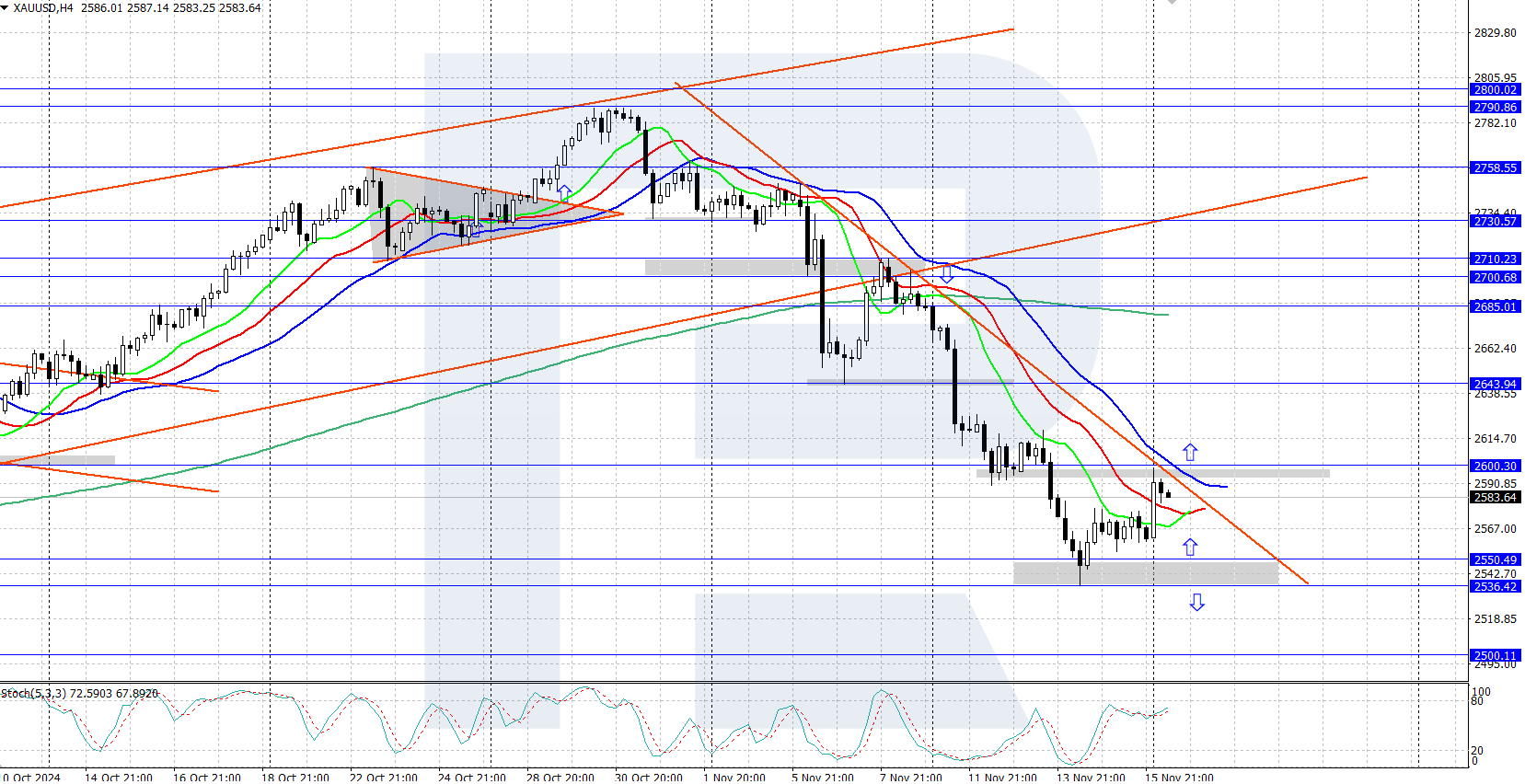

On the H4 chart, the XAUUSD pair is in a downward correction. Asset prices tumbled to 2,536 USD last week, where they encountered strong demand from buyers and reversed upwards. A local low may have formed, from which another growth wave might begin as the long-term trend is upward.

The short-term XAUUSD price forecast suggests the correction could continue towards 2,500 USD if bears push prices below 2,536 USD. Conversely, if bulls retain the initiative and continue pushing prices upwards, they could return to 2,600 USD and above.

Summary

Gold (XAUUSD) quotes attempt to complete a correction and reverse upwards, securing above 2,550 USD. A local low may form, from which prices might rise to an all-time high of 2,790 USD.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้