Gold (XAUUSD) holds steady above 2,600 USD

XAUUSD quotes are experiencing slight volatility this week, remaining firmly above the 2,600 USD support level. Find out more in our XAUUSD analysis for today, 27 December 2024.

XAUUSD forecast: key trading points

- Market focus: Gold is trading within a limited range due to the holiday week in Europe and the US

- Current trend: consolidating within a sideways range

- XAUUSD forecast for 27 December 2024: 2,640 and 2,600

Fundamental analysis

Gold is set to end this week with moderate gains, having returned to the area above 2,600 USD following a recent downward correction. The decline was driven by the strengthening of the US dollar amid expectations that the US Federal Reserve will pause its monetary policy easing cycle in early 2025.

Overall, XAUUSD maintains a confident position, rising about 30% this year. Gold continues to benefit from demand for safe-haven assets amid geopolitical tensions and monetary easing policies pursued by global central banks.

XAUUSD technical analysis

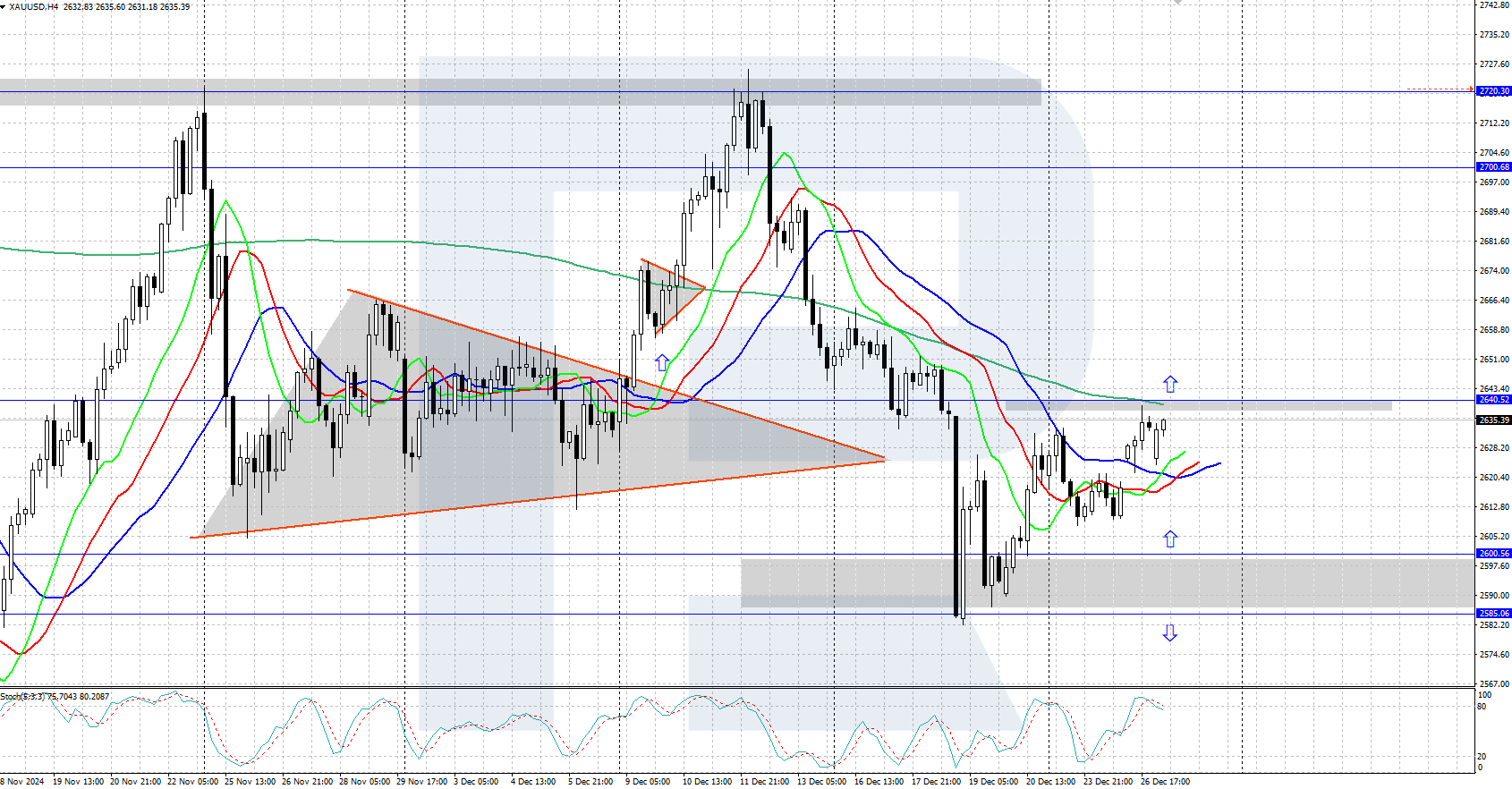

On the H4 chart, XAUUSD has formed an upward reversal from the 2,585-2,600 USD support area following a downward correction. Prices are now consolidating within a tight sideways range, after which the asset may continue to strengthen. The nearest resistance level is at 2,640 USD.

The short-term XAUUSD price forecast suggests that if bullish momentum breaks above the 2,640 USD resistance level, it could pave the way for further growth towards 2,700 USD. However, further declines could occur if the quotes fall below the 2,585-2,600 USD support area.

Summary

XAUUSD prices are gradually recovering after a downward correction, holding steadily above 2,600 USD. The long-term trend remains upward, with Gold likely to continue its ascent in the near term.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้