Gold (XAUUSD) failed to hold above 2,700 USD

Yesterday, XAUUSD prices rose to 2,726 USD during early trading. Still, they failed to hold at that level, entering a correction and declining further in response to the release of US inflation data. More details in our XAUUSD analysis for today, 13 December 2024.

XAUUSD forecast: key trading points

- Market focus: US Producer Price Index (PPI) exceeded forecasts

- Current trend: downward correction

- XAUUSD forecast for 13 December 2024: 2,720 and 2,650

Fundamental analysis

Yesterday’s US PPI data showed an increase of 0.4% month-on-month (forecast: 0.2%) and 3.0% year-on-year (forecast: 2.6%). These elevated inflation figures may prompt the US Federal Reserve to revise its plans for interest rate cuts in 2025. The US dollar gained support after the PPI statistics release, leading to a downward correction in the XAUUSD pair.

The US Federal Reserve is scheduled to hold its regular meeting next week, during which a 25-basis-points interest rate cut is expected. Markets currently estimate the probability of such a cut at 96.4%. Subsequent comments from the regulator regarding future interest rate plans will be crucial for Gold prices.

XAUUSD technical analysis

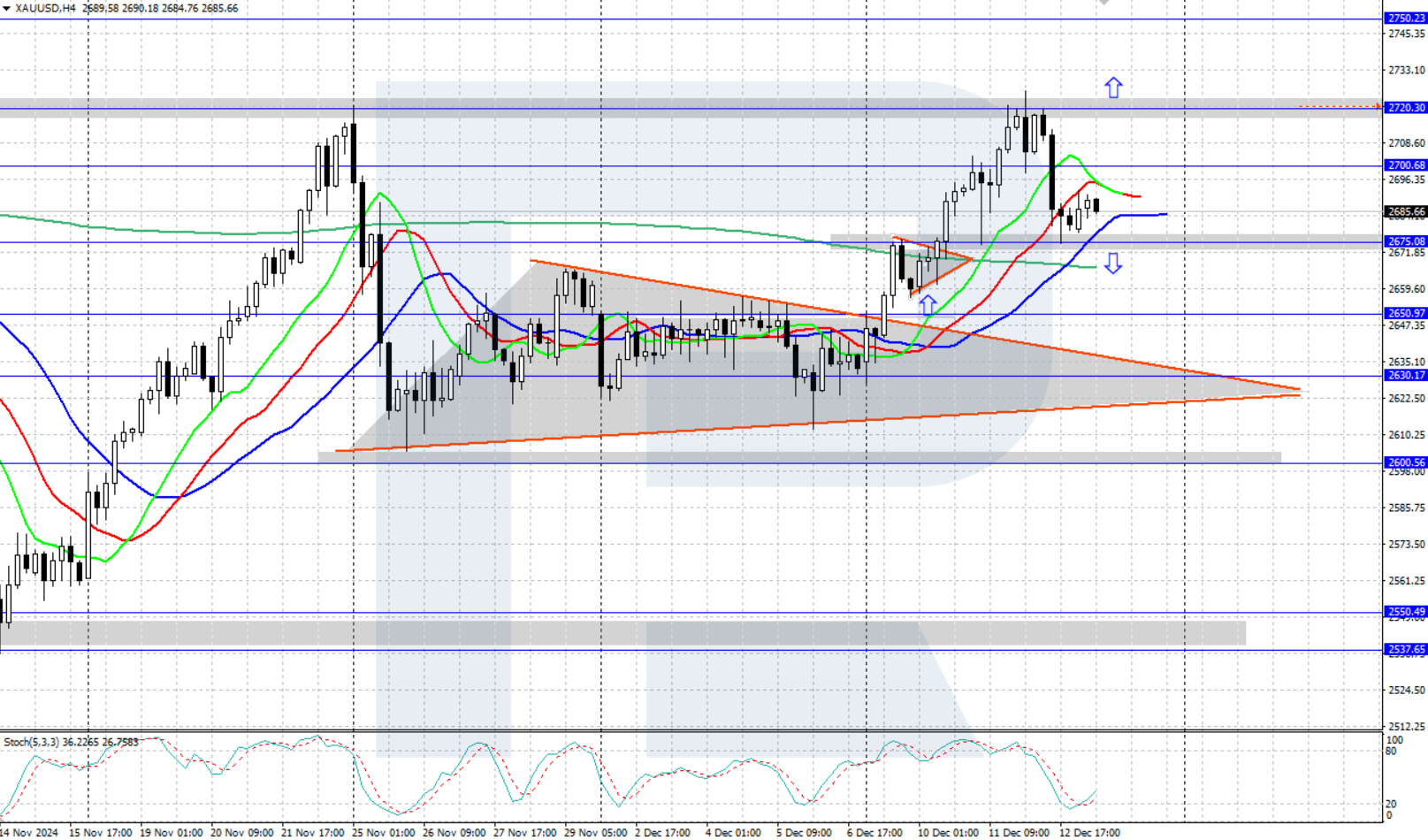

The XAUUSD H4 chart shows a downward reversal from the 2,700-2,720 USD resistance area. A downward correction is underway, after which the asset may resume strengthening. The nearest support level is at 2,650 USD.

The short-term XAUUSD price forecast suggests that if bulls reverse the price upwards and secure a foothold above 2,700-2,720 USD, it could pave the way towards the all-time high of 2,790 USD. However, the decline may persist if bears push prices below the support level of 2,650 USD.

Summary

XAUUSD prices moved into a downward correction following the release of the US PPI statistics. However, the long-term trend remains upward, indicating that the asset may continue to rise once the correction is complete.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้