Brent suspends growth: this is a pause ahead of new purchases

Brent crude oil is stable at around 80.70 USD. The market is assessing demand and the impact of sanctions. Find out more in our analysis for 14 January 2025.

Brent forecast: key trading points

- Brent crude oil rose and halted

- Investors are taking into account the situation with demand in China and US sanctions

- Brent forecast for 14 January 2025: 79.15, 81.02, and 81.25

Fundamental analysis

On Tuesday, the Brent barrel is hovering around 80.70 USD. The market is conserving its strength, continuing to analyse the previously received facts. Tougher US sanctions against Russia may complicate global supplies. There are no indications of significant changes yet, but too little time has passed. The restrictions have affected large ship and tanker manufacturers. The key buyers of Russian oil, such as China and India, will need to seek alternatives to this raw material in other regions. The global oil market will be out of balance for some time.

Signals about the consequences are already emerging: China is initiating supply negotiations with the UAE and Oman, and the news landscape is becoming increasingly tense.

However, weak Chinese demand on a global level may mitigate the effects of such imbalance. Crude oil imports to the country in 2024 contracted for the first time in 20 years (excluding the pandemic period).

The Brent forecast remains neutral for now.

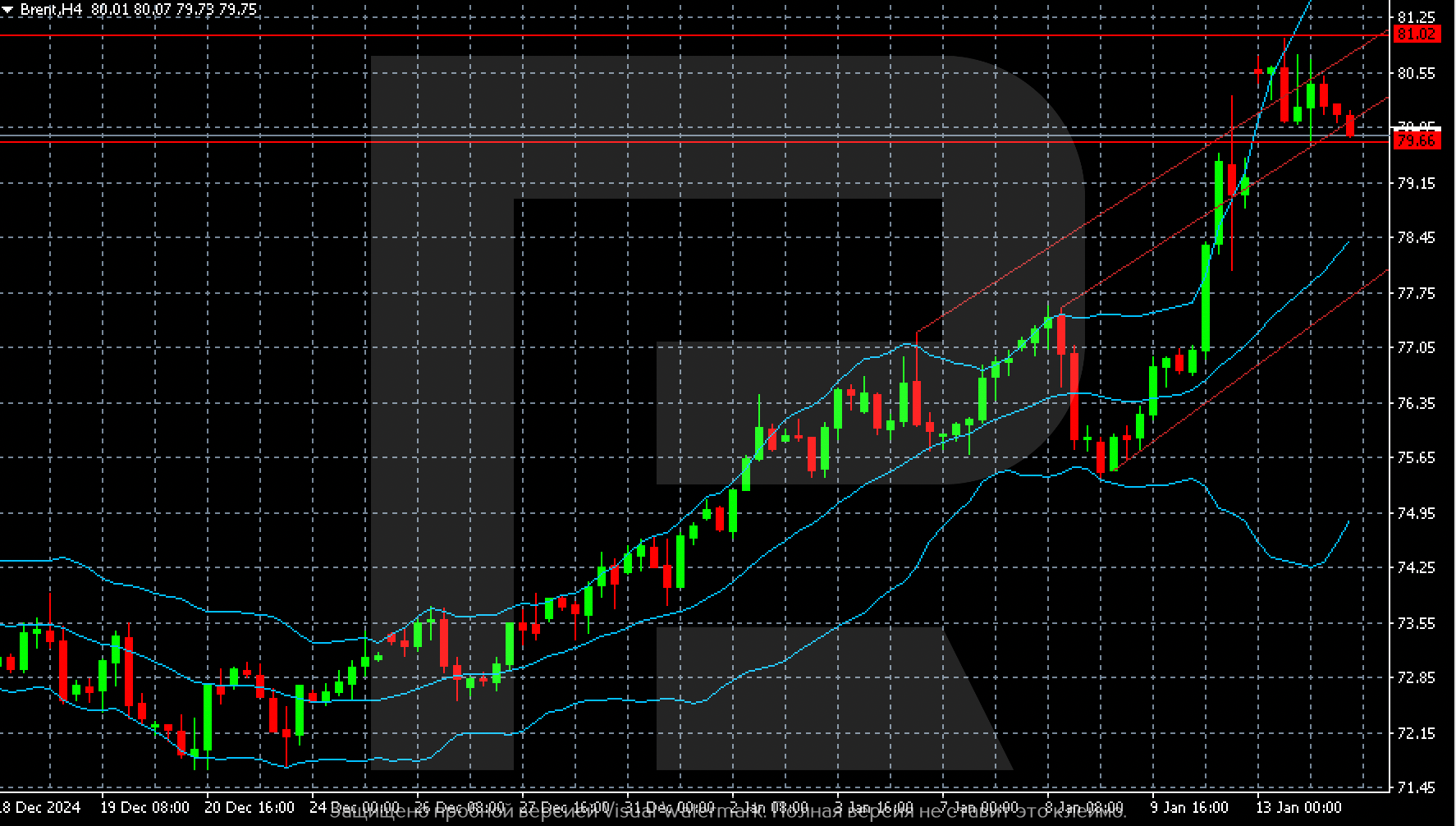

Brent technical analysis

Following steady growth, a local correction is developing on the Brent H4 chart. The Brent price forecast shows that its target is 79.00-79.15 USD. Once the overbought condition is realised, the market could see a buying impulse, with a retest of 81.02 USD as the first target.

The distant growth target is 81.25 USD, from which the price could advance to the range between 81.65 and 81.95 USD.

Summary

Brent rose to a three-month high and stabilised: investors need time to assess key drivers. Today’s Brent forecast suggests that the correction could be complete around 79.00-79.15 USD, with the oil quotes returning to 81.02 (as the first step).

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้