Brent has consolidated above 73.00 USD

Brent is trading within a broad sideways range between 70.00 USD and 76.00 USD, with prices currently hovering around 73.00 USD. Growth to its upper boundary is likely soon. Discover more in our Brent analysis for today, 17 December 2024.

Brent forecast: key trading points

- Current trend: trading within a broad sideways range

- Market focus: market participants are awaiting tomorrow’s decision of the US Federal Reserve

- Brent forecast for 17 December 2024: 73.00 and 76.00

Fundamental analysis

Brent prices remain within a sideways range between 70.00 USD and 76.00 USD. The quotes have consolidated above 73.00 USD and are maintaining upward momentum towards the range’s upper boundary, driven by another escalation in the Middle East.

The American Petroleum Institute (API) will release US oil stock statistics today, with data from the Energy Information Administration (EIA) due tomorrow. A reduction in oil reserves could support Brent prices, while an increase in the figures might push the asset lower.

Market participants are also awaiting the Federal Reserve’s decision on the base interest rate this Wednesday. A 25-basis-point rate cut is expected. This move could support economic growth in the US and potentially boost oil demand.

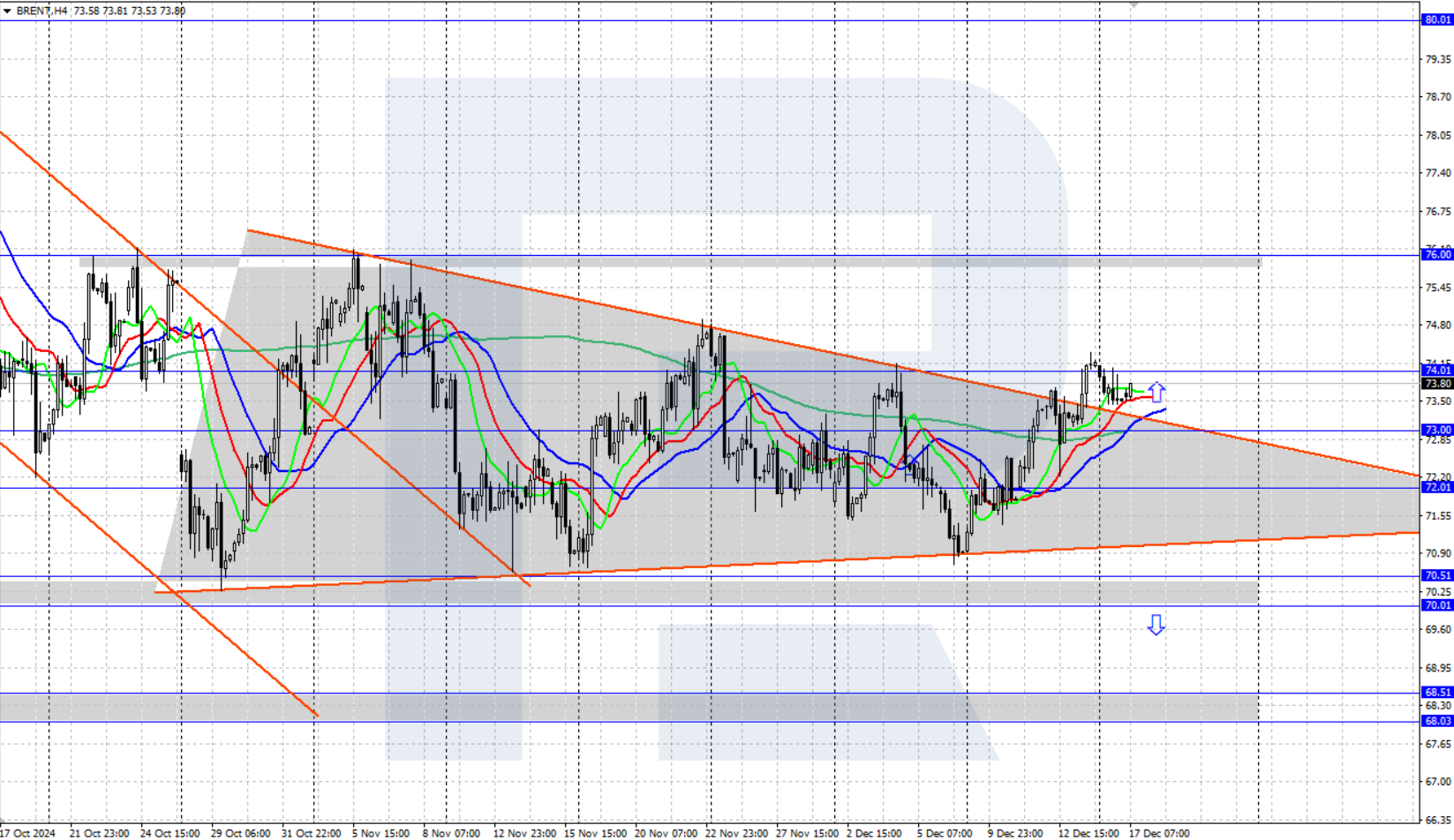

Brent technical analysis

Brent quotes fell moderately on Monday and are consolidating slightly above 73.00 USD today. On the daily chart, the asset is trading within a broad sideways range, with the upper boundary at 76.00 USD and the lower at 70.00 USD.

A triangle pattern has formed within this range, and the quotes have broken above its upper boundary, with the growth target at 79.00 USD. The alligator indicator has reversed upwards and is positioned below the price chart, supporting further growth.

The short-term Brent price forecast suggests growth towards the 76.00 USD resistance level and potentially further to 79.00 USD if bulls hold above 73.00 USD. Conversely, if bears close the day below the 73.00 USD level, prices could decline to the support area around 70.00 USD.

Summary

Brent prices are trading within a sideways range around 73.00 USD. A triangle pattern has formed within this range, and the quotes have broken above its upper boundary, creating conditions for further growth in oil prices.

การคาดการณ์ที่นำเสนอในส่วนนี้จะสะท้อนให้เห็นความคิดเห็นส่วนตัวของผู้แต่งเท่านั้น และจะไม่สามารถถูกพิจารณาว่าเป็นแนวทางสำหรับการซื้อขาย RoboForex ไม่รับผิดชอบสำหรับผลลัพธ์การซื้อขายที่อ้างอิงตามคำแนะนำการซื้อขายที่อธิบายเอาไว้ในบทวิจารณ์การวิเคราะห์เหล่านี้